On 22 September, the container ship Istanbul Bridge completed loading over 1,000 TEUs at the Beilun Port Area of Ningbo‑Zhoushan Port and set sail at around 04:30 the next morning, bound for Felixstowe in the United Kingdom. Rather than follow conventional maritime routes via Suez, the vessel will traverse the Northeast Passage through the Arctic, achieving a one-way transit time of just 18 days. This voyage marks the formal inauguration of the world’s first Arctic container express route between China and Europe—a high-stakes bet on alternative logistics corridors.

That timing could hardly have been more significant. On 11 September, Poland announced it would suspend all railway border crossings with Belarus, citing escalating military activity associated with the Russia-Belarus Zapad‑2025 exercises. Because the China–Europe Railway Express depends heavily on the Belarus–Poland link—especially at the key transshipment hub of Małaszewicze—the border closure effectively halted about 90 percent of rail freight between China and Europe.

While Poland framed the move as a defensive measure, the timing and scale suggest deeper strategic calculation. The rerouting of a flagship rail route during heightened geopolitical tensions places Warsaw in a position to exert pressure on supply chains linking China to Europe. Analysts have described the closure as a “speed bump” for the China–Europe Railway Express, warning that Warsaw risks damaging its standing as an essential transit hub if the suspension prolongs.

From the European Commission’s perspective, the shutdown is being closely monitored. Belgium and Brussels have expressed concern that the closure disrupts a major trade artery: approximately €25 billion in goods per year may be impacted. While this accounts for only a fraction of the China–EU trade volume (over €732 billion in 2024), it underscores how much has been invested in predictable overland logistics. China has also publicly objected: its foreign ministry called the China–Europe Railway Express a “flagship project” of China–Europe cooperation and urged that Poland take effective actions to ensure safe and smooth operation.

Within days, more than 130 freight trains were reported stranded in Brest on the Belarusian side, unable to cross into Poland. Logistics operators estimate that it may take 7 to 10 days of continuous effort to clear the backlog, assuming both Belarus and Poland run operations nonstop. Meanwhile, per-shipment delays are expected to rise modestly—in the short term, transit times may stretch by 2 to 5 days, plus additional handling and storage costs. Some shipping firms have already begun evaluating alternative routes via the Caspian Sea and through St. Petersburg or the Baltic for onward transit.

For China, the stakes are more than logistical. The rail corridor had become a central component of the Belt and Road narrative—a faster, more reliable overland link to Europe that could rival sea freight for time-sensitive goods. As e-commerce platforms and high-value manufacturing increasingly depend on just-in-time delivery, disruptions to the rail link imperil not just costs and schedules but the credibility of China’s trade diplomacy.

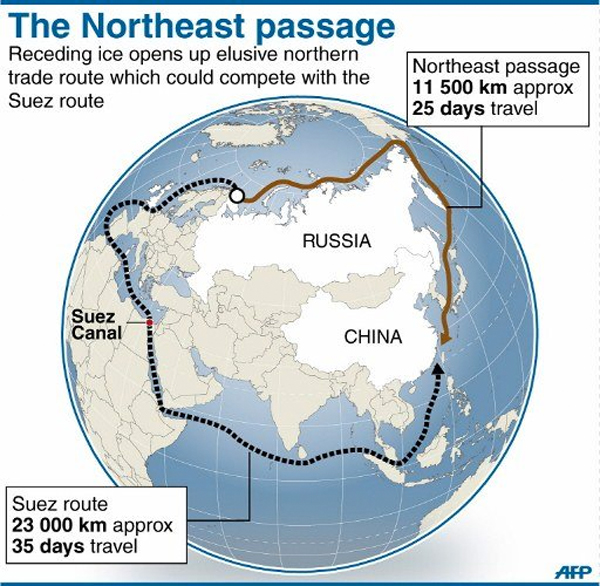

In this context, the Arctic container route via the Northeast Passage becomes more than a novelty—it takes on strategic weight. While the route is subject to seasonal constraints (typically navigable between April and November) and varying ice conditions, it offers an alternative channel less vulnerable to land border disruptions. Because vessels can carry far more cargo than a single train (1,000+ TEUs vs. a rail train’s 90–120 TEU capacity), even a modest shift of freight volume can relieve pressure on congested land routes.

That said, the Arctic route is not a drop-in replacement. It operates under different dynamics—fixed schedules are harder to maintain in icy seas, icebreaker support may be required, and costs can shift unpredictably depending on ice conditions and fuel. Nonetheless, the rapid organization behind Istanbul Bridge’s voyage—completed within roughly 11 days of Poland’s announcement—demonstrates Chinese shipping firms’ ability to mobilize quickly in response to disruption. This agility is underpinned by a broader strategy: state-backed firms pioneer new corridors, validate feasibility, and private operators follow with commercial operations.

Poland’s move underscores a deeper tension: infrastructure that enables trade is also vulnerable to geopolitical pressure. For Poland, using transport control as leverage is risky. If the suspension is prolonged, it could erode Warsaw’s reputation as a reliable transit hub—opening space for competitor routes and partners to bypass Polish linkages. Meanwhile, Chinese exporters face increased premiums, delays, and forced reliance on maritime routes or more circuitous overland paths—raising costs and reducing predictability.

At a systemic level, the incident reinforces one of logistics’ harsh truths: resilience is not about a single optimal path but redundancy. The emergence of the Arctic route, more intensive use of the southern corridor (through Central Asia, Caspian, Turkey), and potential future routes via China–Kyrgyzstan–Uzbekistan reflect a push toward network diversification. Should one node or border falter, alternatives must already be in place.

By navigating ice and circumventing borders, China is signaling its intent: it will not be held hostage to terrestrial chokepoints. For the rail network that long carried its overland dreams, the lesson is clear—flexibility may now matter more than efficiency.

Source: SCMP, Global Times, People’s Daily, defencepk, X, AFP