Where was the first stock exchange in China?

Shanghai? It has the earliest time for approval – 26 November 1990.

Shenzhen? It has the earliest centralized trading time – 1 December 1990.

But in fact, Beijing predated Shanghai and Shenzhen.

As early as 1918, a stock exchange was born in Beijing. However, it was the product of the continuous issuance of public bonds by the Beiyang government to deal with the domestic separatist situation, and it had little to do with corporate development fundraising. Therefore, it withdrew from the stage of history after the socialist transformation in 1952.

Since the proposal of “establishing Beijing stock exchange” was first put forward in 1988, after the establishment of the Shanghai and Shenzhen stock exchanges and the continuous growth of the Chinese stock market, the A-share market has grown into the world’s second-largest stock market. This journey has taken 33 years.

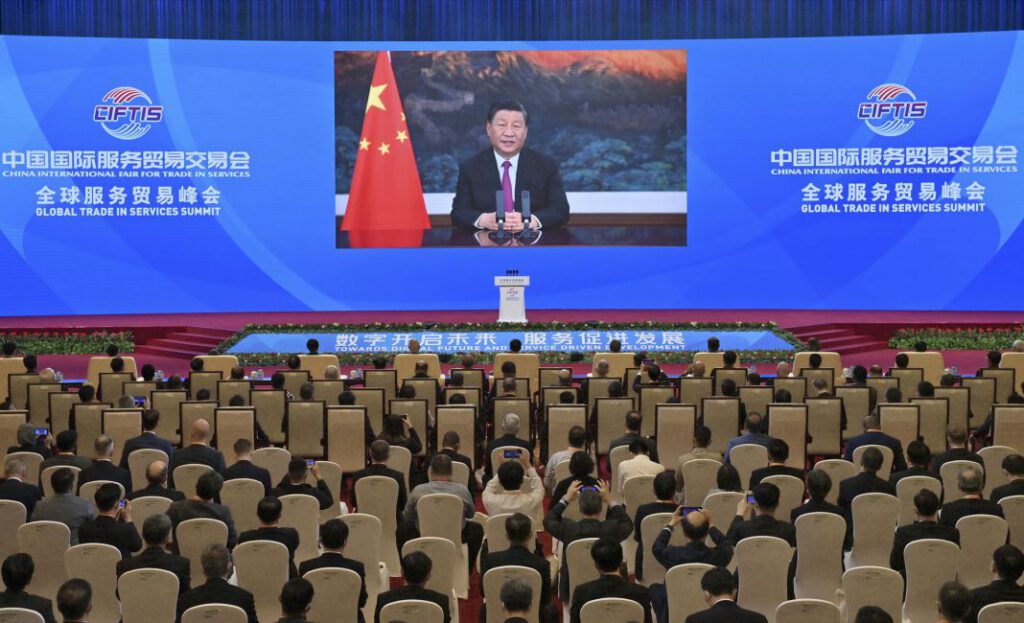

On 2 September, at the Global Trade in Services Summit of the 2021 China International Fair for Trade in Services, China’s President Xi announced that to continuously support the innovation and development of small and medium-sized enterprises(SMEs) and deepen the reform of the “new third board,” China will establish the Beijing stock exchange.

On 3 September, Yang Zhe, deputy director of the Department of Unlisted Public Company Supervision of the China Securities Regulatory Commission, stated that the Beijing stock exchange will be built based on the existing National Equities Exchange and Quotations(NEEQ) selection layer. There will be no price limits when listing new stocks, but from the next day of listing, the price limit is 30%.

What is China’s new third board?

In 2000, to solve the problem of share transfer of delisted companies on the mainboard market, the Securities Association of China coordinated with some securities companies to set up an agency share transfer system, called the third board, which is the “old third board.”

However, due to the small number of stocks listed on the “old third board” and most of them have low qualities, it is very difficult to transfer them to the mainboard and then to attract investors, so these stocks have been ignored for many years.

To improve this phenomenon, China’s securities regulatory authority established a new share transfer system in Zhongguancun Science Park in Beijing, which is called the “new third board.” The listing requirements and trading rules of the “new third board” have been changed. In addition to institutional investors, individual investors can also participate in the trading.

Since the official operation of the NEEQ in 2013, Chinese SMEs have continued to gather. The number of companies on the new third board used to exceed 10,000, and currently, there are 7,304 companies, with a total market value of more than 260 billion euro.

Large-scale SMEs have obvious characteristics of differentiation. Some companies have fast income growth and strong profitability, while others have unstable operations and normal losses. This makes the investment risk of the new third board relatively high.

To further protect the rights and interests of investors, the China Securities Regulatory Commission launched the comprehensive deepening of the NEEQ reform in 2019. One of the key reform measures is the establishment of a selection layer and the establishment of a transfer listing mechanism for listed companies. The division is based on market value conditions, financial conditions, equity dispersion conditions, and regulatory requirements. The new third board is divided into basic level, innovation level, and selected level. Listed companies with different conditions are included in different market-level management, and the selected layer is the highest.

As of 3 September, there are 66 companies on the NEEQ selected layer, with average revenue of 87.09 million euro in 2020, and more than 70% of them have increased the net profit year-on-year in the first half of 2021.

Are the three Chinese exchanges complementary or competitive?

About the establishment of the Beijing stock exchange, there are also some worries about whether the three Chinese stock exchanges will have the “zero-sum game” situation that occurred in the Shanghai stock Exchange and the Shenzhen stock Exchange.

On 2 September, the China Securities Regulatory Commission emphasized that the market positioning of the Beijing stock exchange is to firmly adhere to serving innovative SMEs and to adhere to dislocation development and interconnection with the Shanghai and Shenzhen stock exchanges and regional equity markets.

Therefore, it can be understood that their relationship is cooperative rather than competitive. The Shenzhen stock exchange focuses on venture capital enterprises, and the Shanghai stock exchange focuses on state-owned large and medium-sized enterprises. In the process of operation, SMEs must become bigger and stronger to be listed on the mainboard oneday, and the Beijing stock exchange needs to play a better role in listing them on the transfer board.

From the perspective of investment, the Beijing stock exchange is dominated by qualified investors. Investment preferences and behavioral characteristics are quite different from those of ordinary retail investors. Transactions are relatively low-frequency and rational, and the holding period is relatively long. It pays more attention to the medium and long-term benefits brought by corporate growth.

In the eyes of outsiders, the Beijing stock exchange will complement the environment in recent years after the gradual tightening of overseas financing channels, especially in the United States. It released a message that even if financing opportunities in the US market diminish, entrepreneurs can still obtain capital in China. The return of Chinese companies listed overseas will also help further enhance the global status of the domestic stock market. A continuously rising and improving new money VS a continuously falling and breaking old money, it’s doubtless about which one will be more preferred by the global investors.

(Source: CGTN, China Securities Regulatory Commission)