Policy challenges for Europe

Main findings and recommendations

- With the rollout of export controls on emerging technologies starting in 2020, the United States has opened a new front in its confrontation with China. This marks a shift from defensive measures to more offensive tools.

- Over the past year, the US has engaged in an aggressive campaign to convince European partners to ban Chinese suppliers from their 5G networks. Its push to curb the transfer of sensitive technologies to China risks becoming a new source of transatlantic tension in the years ahead.

- In a world of deeply integrated, global supply chains, European governments view export controls as a blunt instrument for tackling the risks tied to new technologies. They are skeptical about the US administration’s aims, seeing controls as part of a broader push to contain China.

- Despite this scepticism, European countries can neither ignore the US push nor refuse to engage with Washington as it presses ahead with its plans. On the contrary, Europe must formulate its own, considered approach to the transfer of sensitive technologies. Affected member states must coordinate their work more effectively and consider giving the European Commission a broader mandate, as they have done on investment screening and 5G.

- The EU faces unique structural hurdles in responding to the US push to restrict emerging technology transfers. Despite a years-old legislative push to reform the EU’s dual-use regulations, the bloc still has a weak mandate on export controls and limited scope to ramp up its scrutiny of emerging technologies.

- The EU and its member states are not well positioned to address highly complex policy questions at the nexus of technology and security. While officials in some member states have begun to wrestle with these questions, there is a lack of high-level political attention, hindering progress, and leaving the bloc vulnerable.

- The United States has been reaching out to allies on a bilateral basis and in various ad-hoc and established forums, including multilateral regimes like the Wassenaar Arrangement, to get their buy-in. But there is a risk that Washington loses patience with Europe and other allies if they move too slowly and goes down a unilateral path. This could expose European companies to secondary sanctions.

- Those EU states that are most affected should consider creating new structures to address risks at the intersection of trade, technology and security. They should formalise coordination and information exchange with other EU governments and ensure this exchange is grounded in a European process involving the Commission, which needs a more robust mandate to tackle the growing emerging technology challenge.

- States should accelerate efforts to bring outside experts from business and academia into the policy discussion. And they need to establish a more regular, structured dialogue on emerging security challenges with partners outside of Europe, particularly in Asia.

1. Export controls open new front in US-China tech war

“The EU has the option of becoming a player, a true geo-strategic actor, or being mostly the playground.”

—— Josep Borrell, High Representative of the EU for Foreign Affairs and Security Policy1

On January 3, 2020, the Bureau of Industry and Security (BIS) at the US Department of Commerce unveiled the first in a series of proposed rules to limit the export of emerging technologies2. The announcement did not garner much in the way of public attention. After all, it was highly technical in nature (the technology in question was software to automate the analysis of geospatial imagery). But symbolically, the move was significant: it was the first shot from a new front in the Trump administration’s accelerating technology war with China.

Over the past two years, the United States has unveiled a dizzying array of new legislation aimed at China. The Foreign Investment Risk Review Modernization Act (FIRRMA) of 2018 and the Executive Order on Information and Communications Technology and Services (ICTS) of 2019 can be seen as defensive measures designed to shield US companies, technology and critical infrastructure from Chinese investors and suppliers. But the Export Control Reform Act (ECRA) – together with the administration’s liberal use of the Entity List, an export blacklist targeting end-users rather than products – has set the stage for a more offensive approach: a campaign to prevent China from obtaining vital technologies that the United States suspects could be used for military purposes3.

While emerging technologies have always been part of the discussion on export controls, ECRA, signed into law by President Donald Trump in August 2018, signals a new, more intense focus on this area as part of the administration’s aggressive “whole of government” response to China’s rise as an economic, military and, increasingly, geopolitical power. ECRA grew out of a Department of Defense report in early 2018, which described intense Chinese government efforts in Silicon Valley to acquire advanced technologies4.

In explaining the new focus on restricting exports of these technologies, US government officials have highlighted China’s “Military-Civil Fusion” (MCF) strategy under President Xi Jinping. “Simply put, in the context of MCF, it is impossible to rely upon any Chinese promise of purely peaceful or civilian end use if the technology in question has value to China’s security services or its military,” Christopher Ford, Assistant Secretary of State for International Security and Non-proliferation said in September 20195. Because China has blurred the lines between the civil and military spheres as part of an overarching strategy, the administration’s argument goes, a broader interpretation of what constitutes dual-use technologies is warranted.

There are divisions within the US government about the extent to which export controls can and should be used to limit the transfer of new technologies to China6. Memories are still fresh of efforts in the 1990s to restrict the export of satellite technology, a campaign that backfired spectacularly when US manufacturers simply moved their operations abroad7. But the broad push enjoys bipartisan support in the US Congress and is likely to remain a pillar of US policy, regardless of who is sitting in the White House.

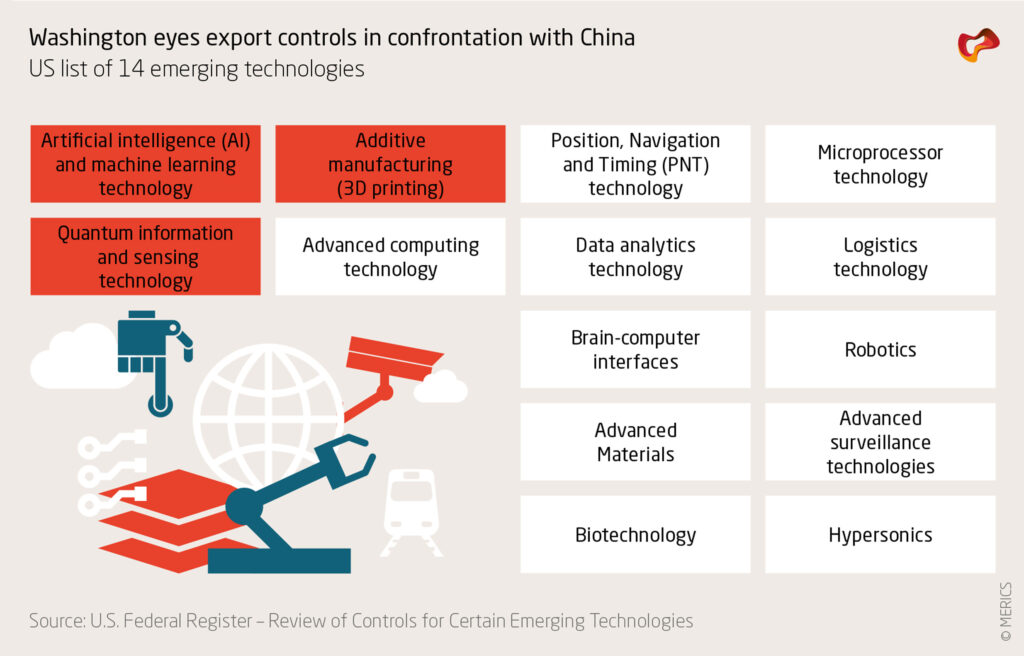

Three months after ECRA was signed into law, the BIS unveiled a list of 14 broad technology categories (see exhibit 1) that it said would be evaluated for possible national security risks.

Exhibit 1

It spent a year analyzing these technologies and seeking feedback from industry, experts and allies. After issuing its first rule proposal on January 3, the US campaign is poised to accelerate in 2020 as the United States rolls out additional export controls and ramps up pressure on allies, including those in Europe, to follow its lead. It has signaled that its initial focus will be on artificial intelligence, quantum computing and 3D-printing. Later it is expected to turn to so-called foundational technologies like semiconductor manufacturing equipment and design tools.

The case of Dutch company ASML (see case study/box 1) shows that the United States has already begun heaping pressure on allies to restrict exports of certain goods to China8. Recent signals that Washington is considering reducing the 25 percent US content threshold above which it can require a US export license from foreign companies suggests a much more aggressive approach going forward9. Indeed, after an intense, aggressive US lobbying campaign in 2019 to convince European allies to exclude Chinese suppliers from their 5G networks, the debate over restricting transfers of sensitive technologies has the potential to become an even bigger and more enduring source of transatlantic tension in the years ahead.

2. Europe views US export restrictions with skepticism

“Historically, export controls have been an instrument of economic warfare. They have depended on a clear-cut idea of an enemy. Europe doesn’t perceive China as the enemy. But it still has to think about this. The US is moving fast. It forces Europe to take a position.”

—— Mario Daniels, Georgetown University10

The US push to restrict exports of sensitive technologies to China has significant implications for European states and industry and will confront the EU with a series of difficult choices beginning in 2020. The EU shares many of Washington’s concerns about China, from its aggressive pursuit of western technology and vast surveillance state, to its growing military ambitions and human rights record. Yet while a rough European consensus has emerged in recent years on the use of defensive measures to shield companies and critical infrastructure from acquisitive Chinese rivals, there is a healthy skepticism in European capitals about Washington’s use of offensive economic tools, such as export controls, to counter China.

First, export controls are seen by many in Europe as a blunt, antiquated instrument for curbing technology transfers in a world where supply chains are deeply integrated and global. The fear is that they will inhibit innovation and disrupt value chains, doing self-inflicted damage to home-grown companies and industries.

Second, there are concerns that the US effort is being driven not by a fear that western technology could be used by the Chinese for military purposes, but rather by a desire to contain China’s technological rise more generally. This is not a goal that European countries support. Unlike officials in the Trump administration, they do not see themselves in a zero-sum competition with China and are reluctant to take steps that amount to a form of economic warfare. Third, there is a fear, particularly in European industry, that the US push is part of an “America First” industrial policy meant to shore up US companies and industries at the expense of foreign rivals.

Despite these misgivings, Europe cannot afford to ignore the US campaign nor refuse to engage with Washington and other allies on what in some cases may be legitimate concerns relating to the spread of sensitive technologies to an authoritarian China. On the contrary, whether European countries ultimately decide to go along with the United States in restricting the export of certain technologies or to push back against these new controls, Europe needs to formulate its own approach to this issue – as it has tried to do on foreign direct investment from China and security risks related to the rollout of 5G mobile networks. If it fails to do so, the risk is an “every country for itself” approach which opens up new divisions between European states and undermines the leverage of the EU as an actor on trade matters.

Although emerging technology questions may not have been at the front of new European Commission President Ursula von der Leyen’s mind when she promised to make the EU executive a geopolitical force, it is likely that they will end up being at the very heart of this challenge11. As in 2019, when the Trump administration pulled out of the Iran nuclear deal, European companies face a risk of extra-territorial sanctions from Washington if they continue to export technologies that are subject to US controls. Without its own considered strategy and without the tools to implement it, Europe risks being thrust onto the defensive.

3. Europe faces internal challenges in responding to US tech push

“We have taken more than three years to discuss just one of the 14 technology categories on the US list and we can’t even agree on that.”

—— Paul Diegel, senior policy adviser, European Parliament12

European states and the European Union face a number of internal challenges, both short and longer term, in responding to US export controls on emerging technologies. They need to move beyond a years-long impasse over the reform of their own export control rules, raise technology considerations to the top of the political agenda and think creatively about moving beyond old, siloed structures to tackle the growing nexus between technology and security.

3.1 Moving beyong the legislative impasse

The Trump administration’s new focus on restricting exports of sensitive technologies has come at an awkward time for the EU, which has been bogged down for years in a legislative effort to reform its own dual-use export control regime. This process was fueled not by concerns about China, but rather reports that cybersurveillance technology – one of the 14 categories on the BIS list of emerging technologies – originating from Europe had been used by authoritarian regimes to suppress democratic uprisings during the Arab Spring.

The failure to clinch a deal on this narrow technology grouping after nearly 3.5 years of negotiations has raised doubts about whether Europe will ever be united or nimble enough to tackle the array of more complex questions that loom in the escalating US tech war with China. Therefore, moving beyond this legislative impasse in the first half of 2020 – a task which could be complicated by travel restrictions linked to the coronavirus epidemic – should be a top priority for the EU and its member states.

While the EU has a mandate from its members to negotiate trade deals on their behalf, its powers in the realm of export controls remain limited. Until now, the bloc has been a rule-taker rather than a rule-maker. The EU adopts one-for-one controls that are agreed in multilateral regimes like the Wassenaar Arrangement, but it does not have the power to add controls itself13. Nor does it have a formal mandate to explore dual-use risks tied to emerging technologies.

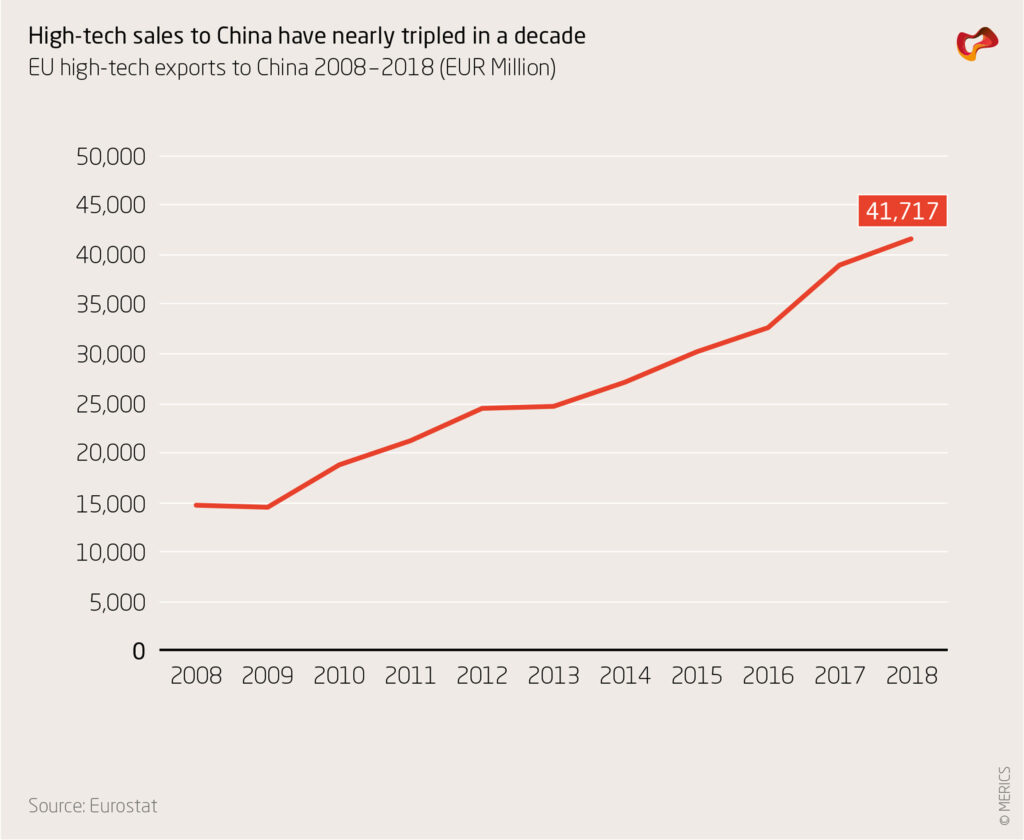

Exhibit 2

Addressing these deficiencies is essential if the EU is to engage with allies and defend the interests of its member states in the intensifying debate over technology transfers. In a worst-case scenario for Europe, the US could come out with a full-fledged list of US export controls in 2020 and Europe would be powerless to deliver a collective response. Then US secondary sanctions could come into play. Against this backdrop, the least bad option for the EU may be to break its multi-year deadlock and conclude a limited deal under the Croatian presidency of the EU in the first half of 2020, even if it stops short of giving the Commission the greater autonomy it is seeking. The bloc could then pivot quickly during Germany’s presidency in the second half of the year to a focused appraisal of emerging technology risks.

The Commission, building on a series of informal workshops it has organized, could be given a coordinating mandate, like the one it received for investment screening and 5G. Still, if the Commission does not get the greater autonomy on export controls that it has sought, the EU will remain reliant on the multilateral regime process and struggle to respond to the US push in a joined-up manner.

3.2 Pushing technology transfers up the political priority list

“On content, the emerging technology issue is very similar to 5G and investment screening. But as far as the political attention goes there is a big difference. This simply isn’t a top priority.”

—— Senior official from a large EU member state14

Although officials in some European member states have begun to wrestle with the question of restrictions on emerging technologies, progress has been hindered by a lack of political attention at the highest levels. This was not the case for investment screening. In early 2017, the German, French and Italian governments, unsettled by a flurry of Chinese acquisitions on the Continent, asked the European Commission to take a closer look at Europe’s foreign investment rules. The Commission produced a proposal half a year later, and by the end of 2018 an agreement had been clinched between the Commission, Parliament and Council to centralize scrutiny of foreign investments.

The comparatively slow progress on reform of the EU’s dual-use export control regime shows that giving the European Commission more powers in this domain is not at the top of the political priority list. The irony, as several European officials pointed out, is that technology leakage via exports is greater than with FDI. While the United States sees export controls and FDI screening as closely linked, complementary tools, European politicians are only slowly waking up to potential risks tied to technology exports. In Europe, the discussion has focused mainly on human rights violations in relation to cyber-surveillance and, more recently, trade with entities in China’s western Xinjiang region.

Complicating the discussion at the EU level is the fact that only a handful of advanced technology-producing states (Germany, France, the Netherlands, Sweden and Finland among them) will be directly affected by US controls.

Therefore, the issue is not a priority for the majority of member states. This will make it difficult to develop an EU consensus on emerging technologies and puts the burden on bigger member states, like Germany and France, to use their clout to push the issue higher up the EU agenda. In order to avert a situation where Europe must scramble to react to US actions, these states will need to drive the discussion forward in 2020.

3.3 Tackling the technology-security nexus

“You need to create the structures to deal with the nexus of trade and security. It is difficult enough to do this at the national level. Just imagine how tough it will be in the EU.”

—— Senior official from a Benelux country

In a world where questions about technology, trade and security are ever more closely intertwined, member states and EU institutions must ensure they have the structures in place to address this nexus. Europe’s fraught debate over 5G has shown that countries like Germany still have a ways to go in this regard.

In Berlin, ministries with conflicting interests that are run by members of rival parties, have struggled to conduct a balanced, fact-based discussion that addresses complex questions about technology, economic competitiveness and national security in a holistic way. In Brussels, Commission President Ursula von der Leyen must ensure that her team of commissioners – notably those focused on trade, industrial policy and digital challenges – are working seamlessly with the European External Action Service to address these questions.

Inter-ministerial working groups have been set up in countries like Germany and the Netherlands to address emerging technology questions. And since late 2019, the European Commission has been arranging voluntary workshops for member states to help them get a better understanding of the security questions related to new technologies like artificial intelligence, quantum computing and additive manufacturing.

But for now, this is soft coordination without a clear political mandate or direct flow into policymaking channels. Old, siloed structures that treat economic and security issues separately are ill-suited for tackling a new nexus that is likely to grow in importance in the years ahead, spurred on by the US focus on restricting the export of sensitive technologies to China.

Against this backdrop, the idea of setting up national security council-type structures in member states like Germany and at the EU level warrants a closer look15. Allies on the front line of the US-China technology war can offer valuable lessons. Japan, for example, is creating an economic statecraft function within its own National Security Secretariat, which will include officials seconded from key ministries as well as outside experts. Japanese ministries are setting up units to address emerging security challenges that would feed into this new body16.

4. US reaches out to allies but could shift to unilateral course

“The Americans are very impatient. And the multilateral regimes are slow. I’m not sure the system will be able to swallow the level of ambition that we are seeing in Washington.”

—— Senior EU official

The choice of whether to follow the US lead in restricting exports of emerging technologies to China will be thrust upon European countries in 2020 – whether they are ready or not. Some, like the Netherlands, are feeling the heat even before new controls are in place (see case study below). What remains unclear is whether Washington will have the patience to build what US officials have called “coalitions of caution” in relation to China, or go down a more unilateral path, pressing ahead independently with controls and using the threat of secondary sanctions to coerce allies to follow suit as the administration did after pulling out of the Iran nuclear deal.

Case Study: ASML

Perhaps no case highlights the risks for European countries of the accelerating US technology war with China better than that of ASML, a Dutch company that makes the machines required to manufacture the world’s fastest semiconductors. ASML is alone among its competitors in producing the most advanced machines that use a chip-making process called extreme ultraviolet lithography. These allow circuits to be etched onto silicon wafers in much smaller sizes, yielding faster, more powerful microprocessors.

ASML sells its EUV lithography machines, which weigh 180 tons and cost about USD 150 million, , to the world’s biggest chipmakers – Intel, Samsung and Taiwan Semiconductor Manufacturing Company (TSMC). The technology is considered “dual-use” under the Wassenaar Arrangement, and thus requires a license for export.

In 2018, ASML received an order for its EUV lithography machine from a Chinese customer, Semiconductor Manufacturing International Corp (SMIC). The Dutch government subsequently came under intense pressure from Washington to block the sale17. It has refused to grant ASML an export license and the company has been unable to deliver the machine to SMIC. In January, the Chinese ambassador to the Netherlands expressed concern that the Dutch were “politicizing our trade relationship under American pressure” and said the move would harm bilateral ties.

ASML’s machine is in many ways unique in the world of sensitive technologies – a large, expensive tool that is vital to China’s ambitions of becoming a high-tech manufacturing power. Very few emerging technologies will share all of these characteristics. Still, the ASML case is a flashing-red alarm for European countries, warning them of the pressures they could come under across a range of technologies in the years ahead.

The early signs are that US officials in the State Department and Commerce Department are keen to establish a dialogue with allies and, where possible, move in unison. In September 2019, the State Department hosted a three-day Multilateral Action on Sensitive Technologies (MAST) conference at which 15 advanced industrial nations, many of them European, compared notes on technology transfer threats. In early December, US officials met with a similar grouping of “like-minded” countries on the margins of the annual Wassenaar Arrangement plenary meeting in Vienna. At that meeting, US officials talked with allies about focusing, in three-month intervals, on “sprint groups” of priority technologies.

But despite these signals, European officials are skeptical that Washington will have the patience to forge a consensus in Wassenaar, a painstaking process that can take several years. A more likely scenario, supported by the recent proliferation of meetings, is that Washington will try to secure the backing of a targeted group of allies, in Europe, Japan and elsewhere, for its emerging technology controls and press them to act outside of the multilateral regime. Individual European countries that decide to go along with the United States could introduce new controls at the national level. Or they might push back if they believe the US proposals go too far. Either way, the process could turn into a nightmare for the European Union, with member states pursuing their own paths and the EU itself unable to act, because under its current legislation, it cannot add controls that haven’t been approved by a multilateral regime.

Longer term, European officials are concerned about the future of the Wassenaar Arrangement. They worry that its approval process may be too slow to keep pace with the rapid pace of technological change. And they see a risk that the United States will lose interest in the arduous process of consensus building within the regime if it can convince advanced technology producing countries to move outside of Wassenaar, either through persuasion or the threat of secondary sanctions.

The concerns mirror those surrounding US efforts to undermine the functioning of the World Trade Organisation (WTO). A breakdown of the multilateral approach to export controls would raise new questions for the European Union, whose own controls are wholly reliant on decisions taken in the regimes. To avoid this, Europe should seek a more regular, structured dialogue on technology & security issues with partners outside of Europe, particularly those on the front-line of the US-China tech war, like Japan, South Korea and Taiwan.

5. Conclusions: Europe must ramp up emerging technology focus

“Either you make your rules or you take them. It is neither in the interests of the EU nor the US to have rule takers only on this side of the pond. We should not sit on the fence.”

—— Sandra Gallina, Deputy Director General, DG Trade, European Commission18

The rollout of new US rules to restrict the export of sensitive technologies to China risks becoming a new source of tension in the transatlantic relationship in 2020 and will confront Europe with a series of complex policy challenges. Despite Europe’s concerns that Washington’s push is driven in part by a desire to contain or slow China’s technological rise, a goal it does not share, EU member states and the European Commission will need to develop their own considered approach to emerging technologies.

If Europe fails to do so, the US campaign could deepen divisions between EU states, undermine the Commission’s role as an actor on trade and threaten the multilateral approach to export controls that has been the basis of EU action for decades.

While the United States has been reaching out to allies in ad-hoc and established forums like the Wassenaar Arrangement, there is a risk that it loses patience with allies and shifts to a more unilateral approach, threatening them with extra-territorial sanctions if they refuse to comply with new US controls aimed at China. For the EU, this goes to the heart of the challenge to become a geopolitical force in a world of heightened competition between the United States and China.

The EU must take action soon if it wants to assert itself as a sovereign actor in this new arena.

First, member states should consider giving the European Commission a formal mandate to explore risks tied to emerging technologies, as they have done in recent years in the areas of investment screening and 5G. In doing so, it will be important not to let stubborn divisions over a multi-year push to reform the EU’s dual-use export control regime get in the way.

Second, leaders from Europe’s biggest states will need to make the issue of emerging technology risks a political priority, ensuring that soft coordination taking place at the national and European level is formalized and is feeding into policymaking channels.

Third, member states and the EU will need to explore creating new structures to help them cope with policy challenges at the nexus of technology, trade and security. Increasingly, this will involve bringing in expertise from outside of government and even rethinking what kind of people they recruit into government. Allies like Japan, which is setting up new functions in its ministries and national security apparatus to tackle emerging security challenges, can offer valuable lessons in this regard.

Rapid advances in technology that require quick policy responses will continue to be a challenge for the European Union, a grouping of 27 member states that operates by consensus and can therefore be slower in responding to new developments. Indeed, the blurring of lines between technology and security call into question a core premise on which the EU is based, namely that centralized rules can govern economic considerations – for example for trade, competition and monetary policy – while foreign and defence issues should be left primarily to member states. In a world of intensifying US-China competition, the EU will find it difficult to paper over these internal contradictions. Instead it must tackle them head-on.

(source: merics.org)