In 2023, Hong Kong SAR, China, solidified its position as Asia’s top hedge fund and wealth management hub, aiming to surpass Switzerland globally. Regulatory reforms and positive interactions between the government and industries drive its success. New policies allowing private equity funds to register under Limited Partnership Fund (LPFs) have boosted Hong Kong’s appeal, matching Singapore’s LPF registrations within three years. LPFs are expected to further influence investment strategies and financial ecosystems in Hong Kong in 2024.

Progressive Logic of Reform

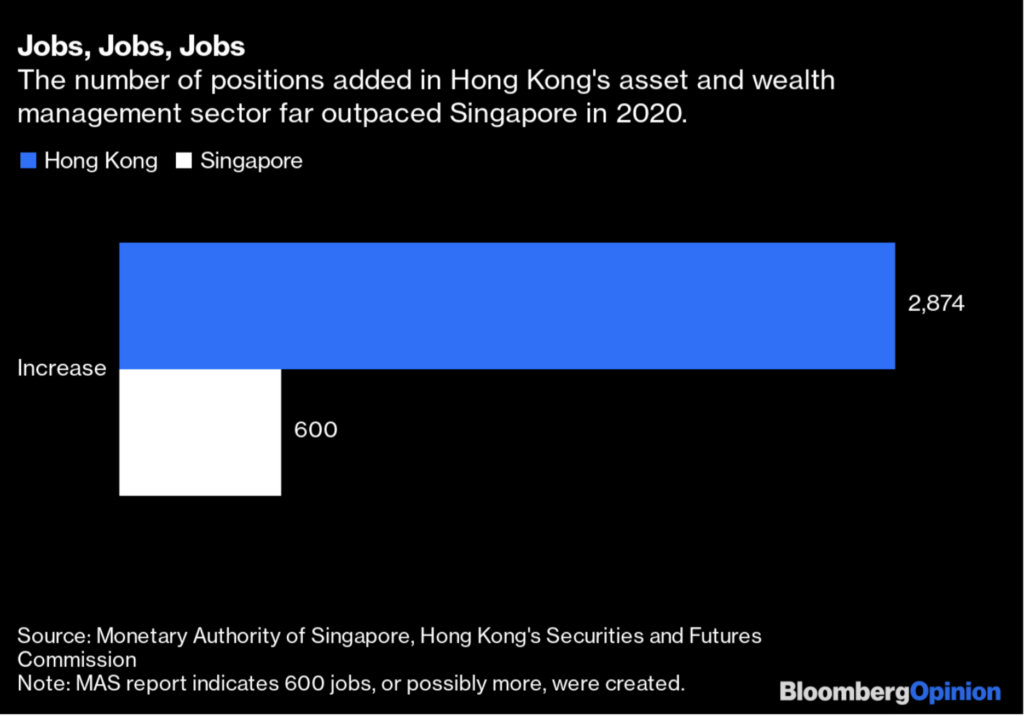

As a Special Administrative Region (SAR) of China, Hong Kong maintains a close economic and trade relationship with the Mainland market. The surge in affluence within mainland China has fueled significant growth in cross-border wealth management activities in Hong Kong. Data from the Hong Kong Securities and Futures Commission (SFC) reveals a staggering 143% increase in assets under management for Hong Kong’s asset and wealth management sector over the past decade.

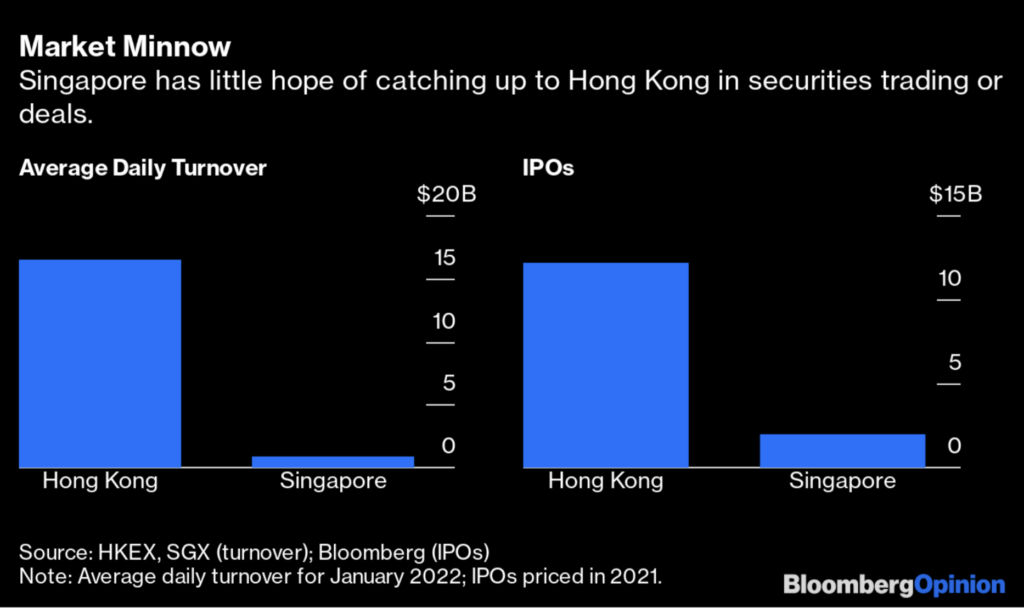

However, industry observers note a shift in dynamics. Previously, before 2018, Hong Kong was the unequivocal offshore destination of choice for mainland wealth management. Yet, recent geopolitical developments and other unfavorable factors have begun to erode Hong Kong SAR’s traditional role as a primary intermediary. In contrast, Singapore has experienced fewer adverse effects and maintains a robust competitive edge and reputation in various aspects.

While Hong Kong boasts strong offshore financial characteristics, a significant portion of its assets under management originates from outside Hong Kong, with many funds not registered locally. This is particularly evident in private funds, where historically, the majority were registered non-locally. Such practices not only impede operational efficiency and increase costs but also complicate compliance efforts.

These challenges are linked to shortcomings in Hong Kong’s company and related systems. The Limited Partnership Ordinance, enacted in 1912, governs business partnerships. However, over time, this outdated system has failed to adapt to the needs of modern investment funds.

Previously, most local funds in Hong Kong operated on a trust-based structure, such as Unit Trusts. Corporate funds from overseas markets launched in Hong Kong typically took the form of public or private offerings. This was due to local restrictions on reducing contributions and allocating funds, often necessitating the establishment of funds as unit trusts. Additionally, until April 1, 2019, there was no tax exemption regime safeguarding investment profits for private equity funds registered in Hong Kong, potentially subjecting them to profits tax.

An official from the Financial Services and the Treasury Bureau of Hong Kong pointed out that the existing legislation lacks flexibility for capital investment and profit distribution, fails to provide contractual flexibility, and lacks a straightforward dissolution mechanism.

In contrast, offshore jurisdictions like the Cayman Islands were favored for incorporating private equity funds due to easy registration, operational flexibility, and fewer restrictions. Exempted Limited Partnerships (ELP) and Segregated Portfolio Companies (SPC) were particularly popular choices for fund managers and investors.

The industry has long advocated for institutional-level reforms, including registration procedures. Amid various pressures, 2020 marked a significant turning point for Hong Kong, China, with the initiation of several institutional reforms.

The introduction of new fund structures allows external funds in Hong Kong to benefit from similar registration forms, thus enticing capital flow into the region.

A pivotal phase in the series of changes can be traced back to 2018. In July of that year, the Open-ended Fund Company (OFC) regime was introduced in Hong Kong, marking a significant shift in fund structure. Investment funds incorporated in Hong Kong gained the option to adopt a corporate fund structure alongside the traditional unit trust structure. They could be established as public or private funds, or as sub-funds, with the flexibility to invest in diverse sectors such as technology, environmental protection, healthcare, and artificial intelligence.

As market recognition grows, funds naturally follow suit. By the end of October 2023, a total of 194 OFCs and 372 sub-funds had been incorporated or relocated to Hong Kong in accordance with relevant policies.

The formal launch of the Limited Partnership Funds Ordinance (Cap. 637) in August 2020 brought significant attention to the LPF system. This operational and management model in the fund industry comprises a general partner and a limited partner, serving as infrastructure widely acknowledged for providing new facilities for the establishment and operation of private equity funds in Hong Kong, as well as offering tax relief.

The range of policy measures implemented by the HKSAR is widely regarded as very competitive due to their flexibility and applicability to various private equity structures. Drawing on past experience and major private equity legal frameworks, these measures have gained significant momentum since their inception.

According to the Hong Kong LPF Association (HKLPFA), the number of local limited partnership fund registrations as of July 2023 had already equaled that of Singapore (680), surpassing it officially in August 2023. By the end of November 2023, this figure had further risen to 740 registrations.

In contrast to Hong Kong SAR of China, Singapore initiated its regime reform much earlier, starting in May 2009. However, despite this early start, Singapore’s number of registrations has not yet reached 700 in 14 years.

Future Challenges and Opportunities

The increasing number of LPFs registered in the HKSAR is catalyzing the development of the asset and wealth management industry in Hong Kong, acting as a new conduit for capital inflow.

From a longer-term perspective, this phenomenon is linked to the classification of the asset and wealth management industry in HKSAR, which encompasses four main areas: private investment, private banking, trust management, and fund consultancy.

According to HKSFC, in 2022, Hong Kong’s assets under management totaled HK$30.5 trillion (US$3.9 trillion), with a net capital inflow of HK$88 billion (US$11 billion). Since the second half of 2022, the funds under management of funds domiciled in Hong Kong have experienced accelerated growth, with assets rebounding by 15% from the third quarter of 2022 to reach HK$1.3 trillion (US$171 billion) by the end of June 2023.

The expansion of scale presents opportunities as the large capital market system and diversified product structure gradually interact with the new models introduced by LPFs. A closer look at the investment categories of LPFs reveals a shift: the proportion of LPFs choosing to invest in a wide range of sectors has decreased from 58% in 2021 to 49% in 2023, while those focusing on investing in specific sectors have increased year by year.

At a micro level, the growing number of LPFs is enhancing the local treasury ecosystem, offering more opportunities for talent growth. Moreover, as acceptance grows, LPFs are emerging as alternative structures for fund managers. Since 2022, private equity fund managers have been leveraging Hong Kong’s LPF structure to invest in diverse industries globally, such as retirement and art collections. Additionally, the number of funds investing in North America and Europe is on the rise.

From the perspective of long-term investors and local financial service practitioners, the proximity to mainland China’s vast market and the continued enhancement of Hong Kong’s IPO listing system are conducive to financing and investment management in Hong Kong. This symbiotic relationship between LPFs and the IPO market holds promise for the region’s fund industry development. For example, mainland investors can leverage the synergistic effects of LPFs and IPO markets when undertaking relevant projects.

From a relevance perspective, a series of HKSAR government policy drives are seen as closely linked to the growth in LPF registrations. In February 2023, in a bid to attract more family offices to Hong Kong, the government allocated HK$100 million in funding to Invest Hong Kong over the next three years. Additionally, in May, the local tax relief ordinance for Family Investment Control Vehicles (FICVs) came into effect, followed by the official launch of the Family Office Service Network (FOSNET) in June. These initiatives, aimed at enhancing the family office ecosystem, are expected to drive LPF development, given their significance in family office asset allocation.

Furthermore, the long-awaited New Capital Investment Entrant Scheme Office (“New CIES Office”), expected to be implemented by the end of 2023, is anticipated to provide further momentum to LPFs.

Looking ahead to 2024, the development of Hong Kong’s offshore RMB business is anticipated to witness further breakthroughs, with LPFs expected to facilitate the flow of funds between Hong Kong and other cities in the Guangdong-Hong Kong-Macao Greater Bay Area, serving as a vital tool for financial interoperability in the region.

According to analysis from People’s Daily, compared to other pilot regions, Hong Kong investors participating in relevant pilots enjoy lower access requirements, a wider investment scope, more convenient cross-border investment processes, simplified consultation processes, and other characteristic advantages.

Source: InvestHK, Bloomberg