The 11th collective study session of the Political Bureau of the CPC Central Committee recently convened to deliberate on the imperative of advancing high-quality development. Presiding over the session, General Secretary Xi Jinping underscored the paramount importance of green development as the bedrock of high-quality progress, asserting that the emerging productive forces inherently embody green principles.

According to the 2023 national power industry statistics released by China’s National Energy Administration, as of December 2023, the nation’s cumulative installed power generation capacity stood at approximately 2.92 billion kilowatts, marking a year-on-year increase of 13.9%. Notably, solar power generation capacity reached around 610 million kilowatts, reflecting a substantial year-on-year surge of 55.2%, surpassing both nuclear and wind power in both cumulative capacity and growth rates.

It is evident that solar power generation plays a pivotal role in the realm of new energy. Solar energy has emerged as the most cost-effective energy source in many nations. In 2023, global installed photovoltaic power generation capacity surpassed that of hydropower. Moreover, forecasts suggest that the photovoltaic industry will maintain a robust growth trajectory over the next decade.

On January 25, 2024, Pan Huimin, deputy director of the International Cooperation Department of China’s National Energy Administration, emphasized at a press conference that China has emerged as an indispensable global leader in clean energy development. Currently, China’s wind power and photovoltaic products have penetrated markets in over 200 countries and regions worldwide, with cumulative export values surpassing US$33.4 billion and US$245.3 billion, respectively.

The International Renewable Energy Agency (IRENA) report highlights that over the past decade, the average Levelized Cost of Electricity (LCOE) for global wind and photovoltaic power generation projects has plummeted by more than 60% and 80%, respectively, largely owing to Chinese innovation, manufacturing, and engineering prowess.

According to data from IRENA, Bloomberg, and other sources, between 2010 and 2022, the cost of photovoltaic power generation in China plummeted from 2.75 yuan/kWh to 0.34 yuan/kWh, marking a staggering cumulative decrease of 87.64%. In 2021 and 2022, the per kilowatt-hour (kWh) cost of coal-fired power generation in China stood at 0.43 yuan/kWh and 0.55 yuan/kWh, respectively. Current cost of electricity generated through photovoltaic systems is lower than that of coal power generation, rendering photovoltaic power generation economically competitive with traditional energy sources.

It is crucial to highlight the profound significance of cost reduction and efficiency enhancement within the photovoltaic industry. For instance, in the realm of household photovoltaics, a prevailing business model involves photovoltaic companies leasing residential spaces to establish photovoltaic power stations. Costs incurred by photovoltaic companies encompass equipment depreciation, rental expenses, operational and maintenance costs, insurance premiums, among others, while their revenue primarily stems from electricity sales.

Data reveals that since 2019, China’s household photovoltaic sector has essentially reached the “grid parity” phase. Subsidies for household photovoltaic installations have steadily dwindled over time, with market dynamics emerging as the predominant catalyst for industry advancement. The fundamental principle at play here is straightforward: unit revenue must surpass unit costs to ensure mutual benefit for all stakeholders involved.

Owing to the concerted efforts across China’s crystalline silicon photovoltaic industry chain, the commercialization of photovoltaic power generation has experienced robust advancement since achieving grid parity. Notably, in 2023, the surge in silicon material supply led to price reductions, resulting in a remarkable 30% cost decrease for photovoltaic modules. Consequently, the internal rate of return on investments in photovoltaic power generation is expected to rise by at least 2 percentage points, significantly catalyzing market growth. Many regions with limited lighting resources now hold investment potential, and ongoing technological enhancements throughout the photovoltaic industry chain will continue to drive the proliferation of high-efficiency, cost-effective photovoltaic products, further expanding the market.

From an industrial standpoint, China’s Ministry of Industry and Information Technology’s official website showcases compelling cases. For instance, the construction of a 51.6MW distributed photovoltaic system, exclusively utilized for self-consumption, along with the implementation of a microgrid within the Yangzonghai Aluminum Industrial Park, resulted in substantial annual electricity cost savings of 20.8 million yuan. Moreover, this initiative led to a reduction in fossil energy consumption by 7,616 tons of standard coal and a decrease in carbon dioxide emissions by 35,347 tons. These achievements vividly demonstrate the economic and environmental benefits inherent in new energy power generation, particularly within industrial green microgrid settings.

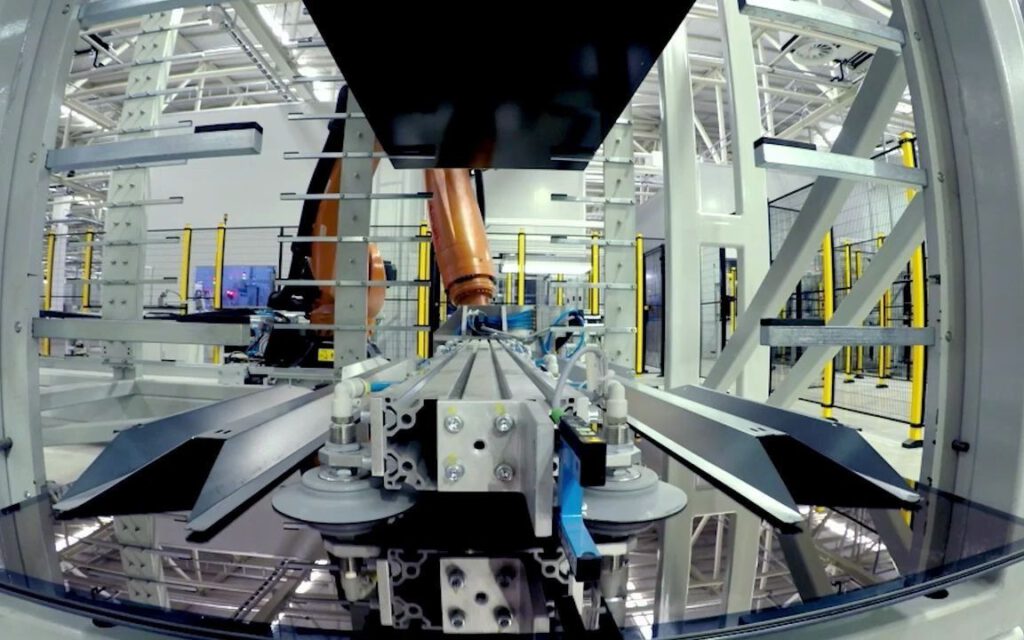

Presently, China boasts the world’s most extensive industrial chain encompassing industrial silicon, high-purity silicon materials, silicon ingots/rods/wafers, cells, modules, inverters, photovoltaic auxiliary materials, production equipment, system integration, and photovoltaic product applications. Each major segment of this chain is fortified by a cohort of globally leading enterprises.

According to customs data, my country has maintained its position as the world’s leading producer of photovoltaic modules for 16 consecutive years, with its global production capacity of polysilicon, silicon wafers, cells, and modules surpassing 80% of the total worldwide output.

The photovoltaic industry, characterized by its reliance on technology and capital, hinges significantly on the photoelectric conversion efficiency of solar cells. In a scenario of overcapacity, mainstream manufacturers in the market are focusing their expansion efforts on advanced production capacity, gradually phasing out outdated facilities to enhance efficiency and reduce costs.

From a global perspective, a report released by the University of Exeter in the UK, predicts that solar energy will emerge as the most competitive energy source in the coming years. Projections suggest that photovoltaic power generation will surpass half of global power generation by 2044. China has played a pivotal role in advancing the global photovoltaic sector. For instance, the Francisco Pizarro Solar Power Plant in Spain’s Extremadura Autonomous Region, operational since 2022, stands as one of Europe’s largest photovoltaic power plants, with all solar panels sourced from China.

Furthermore, a report released by the European Photovoltaic Industry Association projects that the EU’s newly installed photovoltaic capacity is poised to reach 56GW in 2023, marking the third consecutive year of maintaining an annual growth rate exceeding 40%. The total installed capacity of photovoltaic power generation is anticipated to double by 2026, reaching an estimated 484GW. Additionally, Saudi Arabia aims to achieve 40GW of installed photovoltaic power generation capacity by 2030.

In line with these developments, the International Energy Agency (IEA) recently released a report indicating a 50% increase in global new installed capacity of renewable energy in 2023 compared to the previous year, with newly installed capacity projected to reach 510GW. Solar photovoltaics are expected to account for approximately three-quarters of this capacity. By early 2025, renewable energy sources, including photovoltaics, are projected to become the world’s largest source of electricity. For China, which has maintained its position as the leading global producer of photovoltaic modules for 16 consecutive years, numerous opportunities lie ahead.

It is crucial to recall that China’s polysilicon production in 2005 represented only 0.3% of the world’s total, with over 95% of the industry’s polysilicon demand met through imports. It was during this period that domestic companies began exploring the upstream segment of the industrial chain, initiating a journey toward self-reliance.

(Source: Reuters, Global Times)