The semiconductor industry is witnessing heightened tensions amid evolving international dynamics. The United States’ December 2 export restrictions on China’s semiconductor industry, targeting equipment, software, and chips, coupled with the blacklisting of 136 Chinese entities, has underscored these challenges. In response, several Chinese industry associations urged domestic companies to reconsider purchasing U.S. chips. Soon after, China’s regulators launched an antitrust investigation into NVIDIA, leading to a sharp decline in its stock price.

These developments have reignited discussions around the localization of CPUs and other hardware in China. While Intel and AMD continue to dominate the global CPU market, their pursuit of high margins creates opportunities for emerging players. Restrictions on Western technology have also expanded the potential for Chinese CPUs, particularly in infrastructure projects linked to the Belt and Road Initiative.

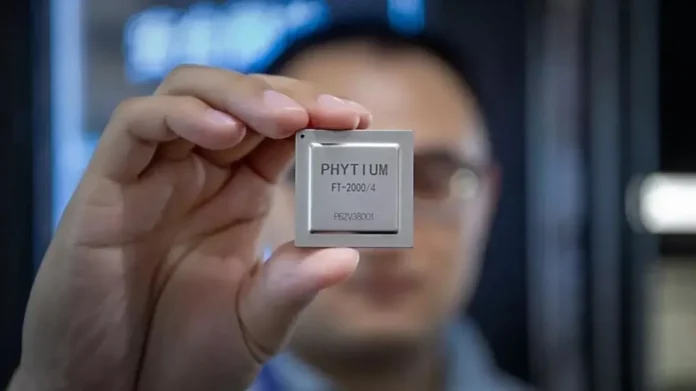

An example of this shift is the recent collaboration between domestic CPU manufacturer Phytium and China Huadian Corporation (CHD). Their partnership led to the successful overseas deployment of the Huadian RuiLan, the distributed thermal control systems (DCS), which uses Phytium’s embedded and server CPUs. These systems were installed in Eritrea’s Beleza and Hirgigo power stations within the span of a year, marking a milestone for Chinese energy projects abroad.

To shed light on the role of domestic CPUs in global competition, Chengyi Zhang. Deputy General Manager, PHYTIUM, recently shared insights on the sector’s trajectory.

Has the overseas expansion of Chinese products been smooth? How has it changed in recent years? What are your thoughts on the prospects of the Belt and Road Initiative and Western markets?

Phytium aims to expand globally, focusing on both the Information technology application innovation industry (ITAI) and ARM-compatible technology, leveraging a mature ecosystem. The initial strategy involves collaborating with major domestic projects that are venturing abroad, while future plans include direct partnerships with foreign machine and solution providers.

Currently, Phytium relies on domestic vendors and integrators for overseas operations, as this approach balances cost, technical support, and after-sales service. As the overseas market grows, Phytium plans to establish direct relationships with international partners.

With Phytium expanding overseas, how do you plan its market and capacity layout amid competition with Intel and AMD?

Phytium offers a comprehensive CPU lineup covering server, desktop, and embedded products. The CPU used in China Huadian’s Eritrea project is part of the embedded line. All three product lines are advancing rapidly, with applications across various industries, forming a balanced growth.

Does Phytium’s current market demand support achieving scale efficiency?

Despite a slowdown in recent years, Phytium’s CPU sales surpassed 10 million units by December 2024, marking a milestone for China’s domestic CPU industry. The sector shows a positive upward trend, with growing opportunities as international restrictions on Chinese chips intensify. However, domestic manufacturers must deliver higher-quality products to meet the increasing market demand.

With multiple approaches in domestic CPU development, how do you view this trend? What are your thoughts on the industry’s ecosystem and future?

The diversity in instruction sets is a natural phase for a developing chip industry, as seen historically in the U.S., which had numerous instruction sets like X86, Alpha, MIPS, and Power during its early stages. Today, China’s three or four instruction sets reflect a similar trend, and the market will likely converge over time.

From a technical perspective, instruction sets act as interfaces, while the CPU hardware design determines performance. High-performance or low-power products can emerge from any route, but the real challenge lies in building a robust ecosystem. Without a strong user base and application scenarios, product maturity and iteration slow significantly.

For less-established routes, the focus must be on building targeted application scenarios and ecosystems rather than spreading efforts too thin. Market trends suggest that ARM and X86 remain dominant, especially in domestic Xinchuang initiatives and international markets, though niche opportunities may exist for other routes. The industry must balance scaling ecosystems with the diversity of application needed to drive long-term growth.

Source: Guancha, Wccftech, Phytium