–Beijing brokers surprise Saudi-Iran diplomatic deal backed by trade and tech infrastructure

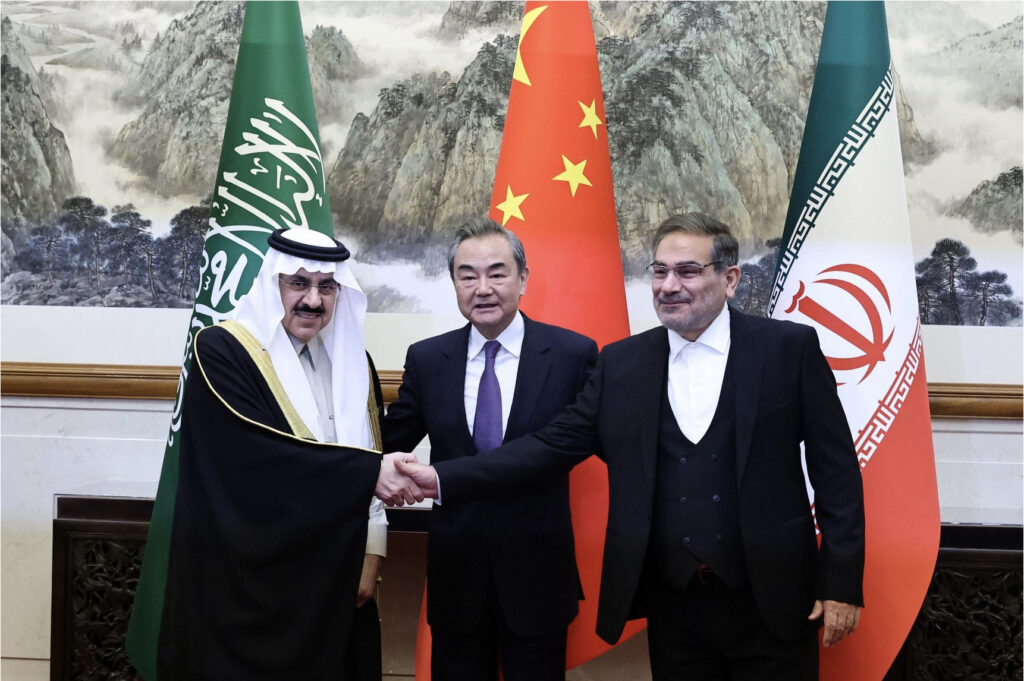

The March 10 announcement that Saudi Arabia and Iran will restore diplomatic relations under China’s mediation drew astonishment from Western commentators.

By American standards, China’s presence in the Middle East is minimal. But China’s footprint in trade and especially technology has grown enormously in Western Asia, allowing Beijing to turn its gradual accumulation of soft power into an unprecedented diplomatic coup.

Saudi Arabia is the evident winner in the agreement. After decades of proxy war between Shiite Iran and the Sunni kingdom, a cessation of hostilities implies that Iran and its proxies will stand down. US National Security Council spokesman John Kirby said on March 10 that “any effort to de-escalate tensions there in the region…is in our interest,” adding that the US welcomes the agreement.

But China’s success in the Persian Gulf points to a breakdown of American attempts to contain China’s global leadership in telecommunications and artificial intelligence (AI) technology. China’s capacity to transform regional economies technologically is a key factor in its diplomatic efforts.

China’s immediate interest in regional stability stems from its dependence on Middle East oil. The last thing Beijing wants is a regional conflict that might interrupt energy supplies. But China’s plans for the region include its industrial potential in a Chinese-led expansion of Eurasian infrastructure.

Although Western analysts were taken by surprise, Chinese diplomacy prepared the Saudi-Iran joint statement, which praised “the noble initiative of His Excellency President Xi Jinping,” over the past several months and in the full light of day. Turkey, which has improved relations with both the Gulf States and Israel during the past year, figures centrally in China’s plan.

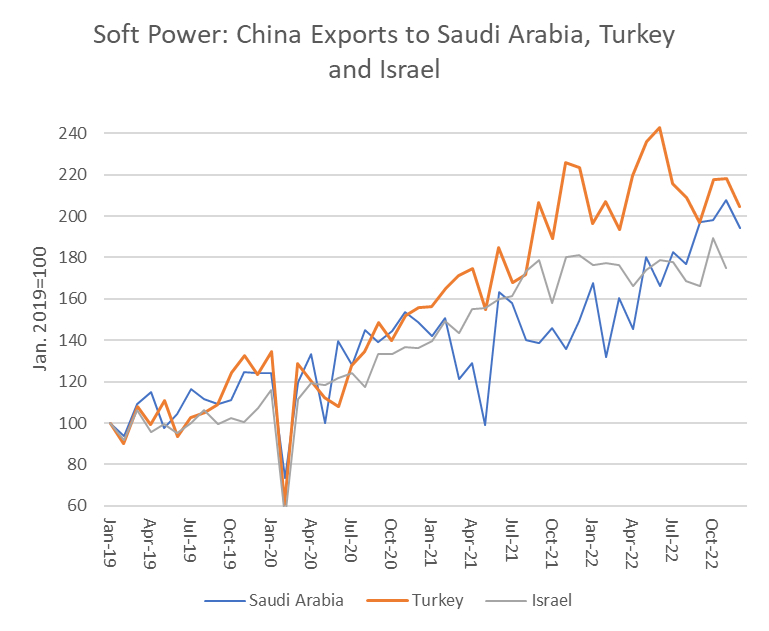

China’s growing influence is evident from trade data, which show its exports to key countries in the region roughly doubled over the past three years.

Some Israeli observers expressed cautious optimism about the Iran-Saudi agreement. Seth Frantzman wrote March 11 in the Jerusalem Post, “Turkey is doing the same] [as Saudi Arabia. Ankara has been reconciling with countries it was hostile towards in the past, such as Israel and the Gulf. This means that in general the Middle East is now an arena of diplomacy, and not conflict. The Abraham Accords, Negev Forum, I2U2 (India, Israel UAE, US) and other groupings have made this clear.”

Last December, China issued a joint statement with Saudi Arabia and other Gulf Cooperation Council (GCC) members branding Iran as a supporter of regional terrorist organizations (“Pax Sinica of sorts taking shape in Middle East,” Asia Times, December 15, 2022), and warned about Iran’s nuclear ambitions.

The statement stressed the need “to address the Iranian nuclear file and destabilizing regional activities, address support for terrorist and sectarian groups and illegal armed organizations, prevent the proliferation of ballistic missiles and drones, ensure the safety of international navigation and oil installations, and adhere to UN resolutions and international legitimacy,” according to a summary published by MEMRI.

That was the first time Beijing had taken sides in the quarter-century conflict between Saudi Arabia and Iran, which backed Houthi rebels against a Saudi-supported regime. Iranian proxies launched a successful drone attack on Saudi oil facilities in September 2019, and against an Aramco refinery in Riyadh in March 2022.

What inducements China gave Iran to sign the agreement with the Saudis is not clear, but it appears that it made Iran an offer it couldn’t refuse. Iran depends overwhelmingly on China for manufactured goods, including weapons and especially missile technology. Beijing’s leverage over Tehran is thus enormous. Although China formally opposes Western sanctions on Iran, the sanctions regime gives China a near monopoly on key Iranian imports.

Turkey’s recent turnabout from sick man of the regional economy to star performer also factored into the Iranian regime’s calculations. Chinese exports to Turkey have tripled since 2019, and Chinese trade financing helped the Recap Tayyip Erdogan government limp through a currency crisis that left the country on the edge of hyperinflation just a year ago.

With the largest army in the region, Turkey presents a counterweight to Iran’s regional ambitions, and its newly restored relations with Israel and the Gulf States indicate that it may become a stabilizing force (“How Erdogan Got Back in the Money,” Asia Times, February 20, 2023).

China has just one military base in the Middle East—in fact, just one in the world—with fewer than 2,000 personnel and only 200 combat troops at Djibouti.

The United States, by contrast, has 7,000 personnel at the Bahrain headquarters of the 5th Fleet, 10,000 at the Al Udeid Air Base in Qatar, 3,800 at the Al Dhafra Air Base in the United Arab Emirates, 2,500 at the Incirlik Air Base in Turkey as well as another 4,000 troops in Djibouti, among other installations.

What China has, and the US does not, is a plan to transform the economies of the region with digital infrastructure, ports, railroads, AI-guided solar power as well as the means to rescue economies in crisis.

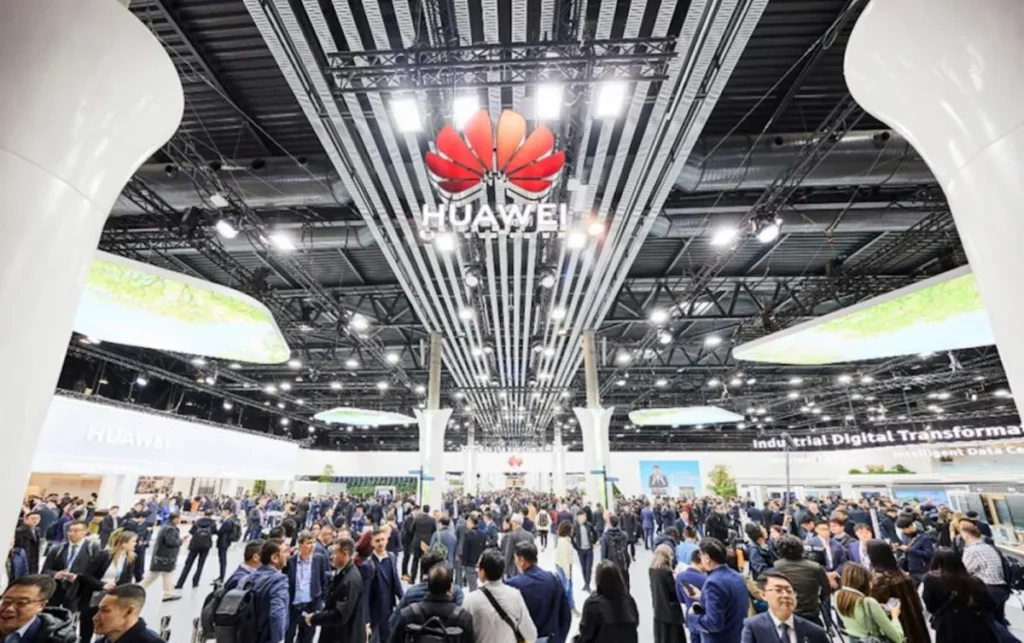

When Xi Jinping visited Saudi Arabia in December 2022, Reuters reported, “A memorandum with China’s Huawei Technologies, on cloud computing and building high-tech complexes in Saudi cities, was agreed despite US unease with Gulf allies over a possible security risk in using the Chinese firm’s technology. Huawei has participated in building 5G networks in most Gulf states despite the US concerns.”

Earlier in 2022, the UAE broke off negotiations to buy America’s F-35 stealth fighter after Washington demanded that the UAE exclude 5G mobile broadband systems that it plans to buy from Huawei. US analysts claimed that Huawei’s civilian 5G network could gather intelligence on American aircraft. The UAE kept its deal with Huawei and bought 80 French Rafale fighters instead.

Huawei’s Red Sea Project, signed in 2019, is building an AI-enabled solar power network that will provide power for a city of one million people.

The Chinese firm dominated the World Mobile Congress in Barcelona last week. Senior American officials deployed to the conference to warn that Huawei could help Chinese spies gather information through its 5G networks.

In a March 1 press conference, the State Department’s cyber chief Robert Strayer said, “The United States is asking other governments and the private sector to consider the threat posed by Huawei and other Chinese information technology companies,” claiming the company was “duplicitous and deceitful.”

Meanwhile, in Exhibition Hall One, representatives of Turkey’s largest mobile provider Turkcell manned a booth inside the sprawling Huawei pavilion to advertise their collaboration with the Chinese company, which provides most of Turkey’s broadband infrastructure.

Huawei officials said that US restrictions on the most advanced computer chips with transistor widths of 7 nanometers or less wouldn’t affect their global infrastructure business, which runs on mature technologies that China can manufacture at home.

(Source: https://asiatimes.com/2023/03/chinas-soft-power-forging-peace-in-middle-east/)