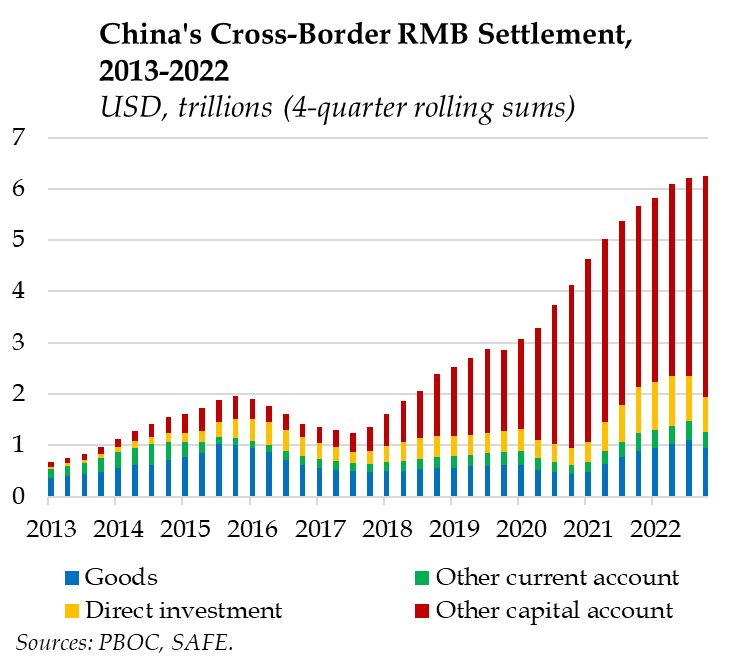

As China’s economic strength steadily increases, its position in the global industrial supply chain continues to rise, and its role in global economic governance continues to grow, the RMB’s functions as an international reserve currency and payment currency continue to grow. Therefore, more and more countries are actively promoting relevant currency arrangements with China.

RMB Internationalization in Orderly Progress

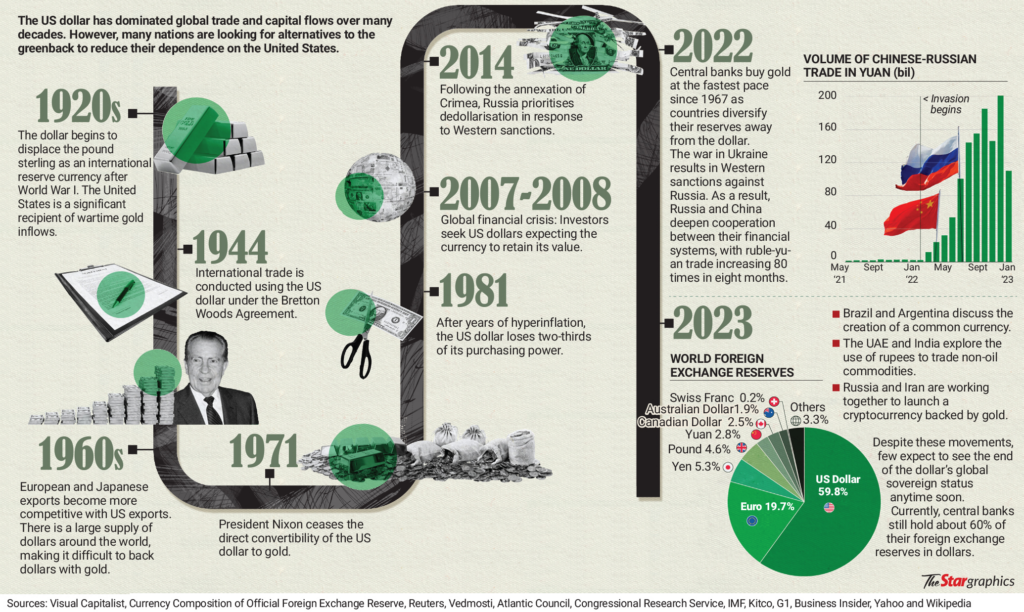

In terms of reserve currency functions, the IMF released the Currency Composition of Official Foreign Exchange Reserves (COFER) data, which showed that the RMB accounted for about 2.7% of global foreign exchange reserves as of the fourth quarter of 2022, ranking fifth among major reserve currencies. During the same period, the U.S. dollar accounted for about 58% of global foreign exchange reserves, the euro for about 20%, the Japanese yen for about 5.5%, and the British pound for about 4.9%.

In terms of payment currency functions, data from the Society for Worldwide Interbank Financial Telecommunication (SWIFT) show that the share of international payments in February 2023 was about 2.19% for the RMB, ranking as the fifth-largest payment currency in the world.

In terms of investment and financing currency functions, China’s financial market opening continues to advance, RMB assets remain highly attractive to global investors, and there is an overall net inflow of RMB cross-border receipts and payments under securities investment. By the end of 2021, the total amount of domestic RMB stocks, bonds, loans, and deposits held by foreign entities was RMB 10.83 trillion, up 20.5% year-on-year, and RMB deposits in major offshore markets were close to 1.5 trillion RMB. The offshore RMB market gradually picked up and transactions became more active.

New Trends and Breakthroughs

The Central Bank of Brazil announced on March 31 that the RMB has surpassed the Euro as the country’s second-largest international reserve currency. By the end of 2022, RMB accounted for 5.37% of Brazil’s international reserves, surpassing the euro’s 4.74% share.

Data released by the Moscow Exchange in early March showed that in February this year, the RMB overtook the U.S. dollar for the first time to become the most traded currency on the Moscow Exchange monthly. According to the latest asset allocation program developed by the Russian Finance Ministry late last year, the Russian Federal State Wealth Fund will not invest in U.S. dollar-denominated assets and will raise the cap on the potential share of RMB assets to 60% from the previous 30%.

In July last year, the Central Bank of Belarus added the RMB to its currency basket. RMB accounts for 10% in its currency basket, the Russian ruble accounts for 50%, and the U.S. dollar and euro account for 30% and 10% respectively.

In December last year, Mauritius became the third African country to host an RMB clearing center, following South Africa and Zambia.

Rising Strength Drives RMB Internationalization

The internationalization of the RMB has benefited from and relied on China’s economic growth, rising comprehensive national power, and the orderly promotion of reform and opening up.

In 2010, China became the world’s second-largest economy, further accelerating the RMB internationalization.

In 2018, RMB became the world’s fifth-largest payment currency and the most actively traded emerging market currency, continuing to move from a settlement currency to an investment, reserve, and denomination currency. The economic foundation for RMB internationalization is sound, and related products, mechanisms, and facilities are increasingly improved.

The “One Belt, One Road” project also promotes the internationalization of RMB. On the one hand, the “Belt and Road” infrastructure construction has created large-scale RMB-denominated assets outside China, and the huge financing demand for projects along the route has further promoted the issuance of dim sum bonds and other bonds in the offshore market, which is conducive to increasing the use of RMB; on the other hand, the project has created a regional monetary cooperation system, which is conducive to reducing the interference of the external environment on the RMB exchange rate and maintaining the stability of the RMB currency.

De-dollarization provides opportunities for RMB internationalization

In the past two years, the trend of de-dollarization of the international monetary system has increased significantly, mainly because the U.S. has abused the hegemonic position of the U.S. dollar and kept “weaponizing” the U.S. dollar and the U.S. dollar payment system.

In February last year, the U.S. announced a freeze of billions of dollars of foreign exchange reserves of the Central Bank of Afghanistan. After the escalation of the crisis in Ukraine, the U.S. froze Russia’s foreign exchange reserves, sanctioned major Russian banks, and excluded some Russian banks from the SWIFT system, leading to sharp fluctuations in international financial and commodity markets.

In addition, to solve the U.S. domestic economic contradictions, the US Federal Reserve’s monetary policy fluctuated greatly, bringing serious negative spillover effects and causing a series of problems to many countries such as substantial turmoil in financial markets, aggravated debt crisis, and severe inflation. These have led to a reduction in the credit of the U.S. dollar, prompting the international community to further reflect on the problems of the U.S. dollar-dominated international monetary system, with more and more countries taking action to “de-dollarize” and seek to establish a more diversified international monetary system to prevent the risks associated with excessive reliance on the U.S. dollar.

On March 31, 2022, Vladimir Putin signed a presidential decree on the settlement of gas trade with “unfriendly” countries and regions in rubles, which came into effect on April 1, 2022.

Israel’s central bank added the Canadian dollar, Australian dollar, Japanese yen, and Chinese RMB to its foreign exchange reserves last year, reducing the U.S. dollar from 66.5% to 61% of its reserves to reduce its exposure to the greenback.

Iranian Supreme Leader Ayatollah Khamenei last July called for replacing the U.S. dollar with national or other currencies in global trade. To reduce the use of the U.S. dollar, Turkey and Russia negotiated a bilateral currency agreement that includes Turkey buying Russian energy in rubles and accepting Russian tourists to spend in rubles in Turkey.

At the ASEAN Finance Ministers and Central Bank Governors meeting that concluded on March 31 of this year, ASEAN members agreed to enhance the use of local currencies in the region and to reduce their reliance on the current major international currencies in cross-border trade and investment.

Brazilian President Lula and Argentine President Fernández said in January that the two countries were studying the launch of a common South American currency. The initiative by the leaders of Brazil and Argentina has been echoed by other Latin American countries.

China’s rising economic strength helps accelerate the internationalization of the RMB, while more countries seeking to establish a diversified international monetary system will also bring opportunities to further advance the internationalization of the RMB. However, in terms of depth and breadth, the RMB is still underrepresented in the global market, and RMB funds flowing out of China need more diversified and efficient channels for investment and value-added use.

In addition, the internationalization of a currency requires a shift from a trade financing currency to a transaction currency, and eventually to an investment and reserve currency. Now that the RMB has been active as a trading currency for a considerable period, it needs to be developed into an investment and reserve currency to fundamentally improve the supply and demand situation of the offshore RMB.

China has a larger population size than the U.S. and does not have a huge debt and trade deficit like the U.S., which provides fundamental support for the RMB to become a reserve currency, said Jim Rogers, a well-known investor attending the 2023 Yale China-U.S. Summit.

UNCTAD senior economist Liang Guoyong said the mature development of the RMB trading market, including the offshore market, is important for the internationalization of the RMB. In addition, the expansion of overseas RMB clearing banks and the expansion of Chinese banks’ overseas presence will also help facilitate the international use of RMB and increase the recognition of RMB by overseas institutions.

(Source: ForumlAS Blog, The Cradle, Twitter)