By the end of 2025, while many major U.S. and European corporations were announcing sweeping global layoffs, several of China’s largest companies were moving in the opposite direction.

Internet giants including JD.com and ByteDance rolled out large-scale pay increases and bonus plans. Automotive supply-chain leaders such as BYD and CATL also announced salary hikes covering extensive numbers of frontline workers.

At first glance, the timing seemed counterintuitive. China’s internet sector is no longer in its high-growth dividend era. Expansion has slowed, competition has intensified and profitability has come under pressure. Yet rather than signaling a return to the industry’s free-spending past, the new wave of pay increases reflects a strategic recalibration in response to structural change, particularly the rise of artificial intelligence.

JD.com said 92% of its employees received full or above-target year-end bonuses for 2025, with total bonus spending rising more than 70% year on year. Its procurement and sales teams were told their bonus ceilings would be uncapped. ByteDance increased its annual bonus pool by 35% and expanded its salary-adjustment budget by 1.5 times, raising both minimum and maximum compensation bands across job levels.

The trend did not begin this year. As early as September 2024, JD.com launched a “20-month salary” upgrade plan, aiming within two years to implement 20-month annual compensation for its retail and functional divisions. Since 2024, Tencent and Alibaba Group have also introduced a mix of equity incentives, long-term cash rewards and salary restructuring programs.

The announcements inevitably revived memories of the sector’s golden age. Around 2015, as short video, O2O services and platform economies exploded, China’s internet heavyweights were widely described as “wealth-creation factories.” In late 2014, Robin Li, chief executive of Baidu, pledged what was then described as the largest bonus pool in the company’s history. Reports at the time suggested that some employees received bonuses equivalent to dozens of months of salary.

Those days, however, have faded. In recent years, many employees have remarked that simply receiving a bonus at all feels fortunate. As market growth narrowed, companies shifted from “expanding the pie” to competing fiercely for existing market share.

In the third quarter of 2025, JD.com reported record quarterly revenue, yet its net profit attributable to shareholders fell to approximately €680 million, down 54.7% year on year amid intense food-delivery competition. In the automotive sector, price wars weighed on performance. BYD’s third-quarter net profit declined 32.6% year on year, while CATL has in recent years faced the challenge of rising profits without proportional revenue growth.

Against this backdrop, the current pay-rise wave appears less like exuberance and more like strategic positioning.

Artificial intelligence has become the defining battleground. As large language models, multimodal systems and AI infrastructure reshape the competitive landscape, top-tier technical talent has emerged as the scarcest resource.

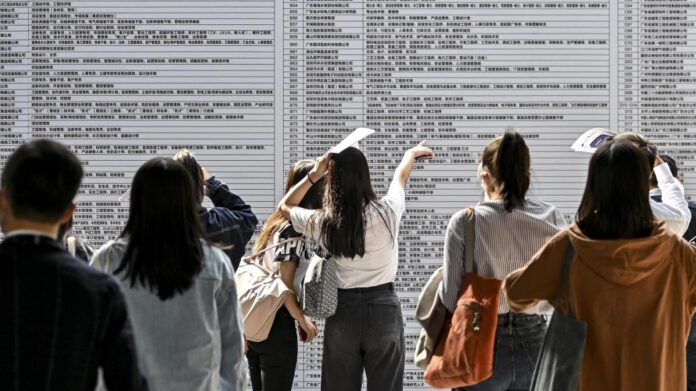

According to data released by the workplace platform Maimai, thousands of companies are recruiting for AI-related roles, with the ten largest recruiters alone posting more than 10,000 openings. Annual salaries for certain AI product managers, algorithm engineers and growth specialists can exceed €128,000, while some highly specialized roles offer up to approximately €164,000.

Tencent has moved aggressively on both campus and global recruitment. Through its “Qingyun Plan,” Tencent targets elite global technology students, mirroring ByteDance’s Top Seed initiative. The company’s “Qingyun Scholarship” awarded 15 doctoral and master’s students incentives worth about €64,000 each, including roughly €25,600 in cash and €38,500 in cloud computing resources, to support research in large models and AI infrastructure.

Tencent’s R&D spending reached approximately €2.9 billion in the third quarter of 2025, a record high for a single quarter. For the first three quarters of the year, cumulative R&D expenditure totaled nearly €8 billion. The company has also recruited high-profile AI scientists from overseas research institutions, underscoring the urgency of the global talent race.

Meanwhile, Alibaba announced plans to invest more than €48.7 billion over the next three years in cloud and AI hardware infrastructure — exceeding its total investment over the previous decade. ByteDance is reportedly preparing to spend about €20.5 billion on AI in 2026 alone.

The recalibration extends beyond elite engineers. CATL raised base salaries for lower-level employees by roughly €19 to €26 per month. JD.com pledged to invest around €2.8 billion over five years to provide housing support for delivery riders and couriers. For companies with vast operational networks, stabilizing frontline staff is critical to maintaining service quality.

After several years focused on cost-cutting and operational efficiency, China’s corporate heavyweights are pivoting toward what could be described as investment-driven competitiveness. In the past, controlling traffic gateways — search, social media and e-commerce platforms — formed the core moat of internet companies. Today, AI systems are redefining those entry points, shifting the competitive focus from traffic ownership to technological depth.

The latest wave of pay increases is therefore not a return to indiscriminate generosity. It is a calculated bet on the next technological cycle. As growth dividends fade and AI redraws the industrial map, talent — whether in advanced research labs or on the delivery front line — has become the most valuable asset. In this new era, companies are investing heavily not simply to reward employees, but to secure their place in the future.

Source: sina finance, the paper, pai, 21jingji, guancha, cctv