The 10th anniversary of the Belt and Road initiative is being celebrated this year. Recently, the Bank of China Head Office has introduced financial services dedicated to supporting the construction of the Belt and Road.

These services primarily focus on RMB cross-border settlement, bond business, and risk control management.

RMB: a crucial complementary financing channel

Liu Yunfei, Deputy General Manager of Bank of China’s Transaction Banking Department, outlined two key initiatives aimed at facilitating cross-border trade and advancing RMB internationalization within the framework of the Belt and Road.

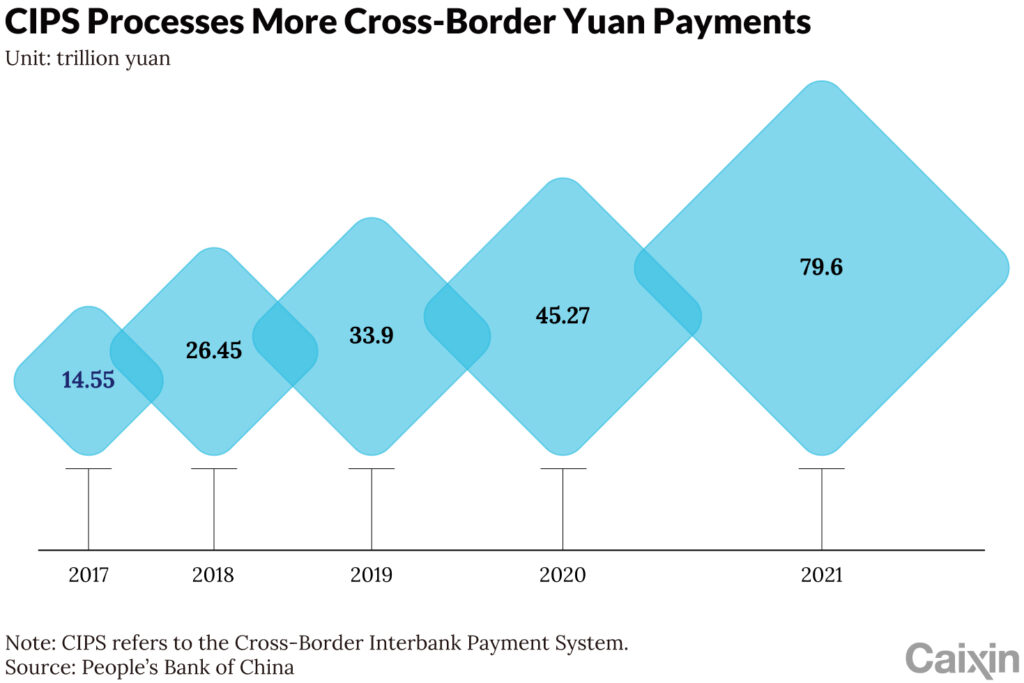

Firstly, there has been a concerted effort to bolster RMB settlement transactions. In the period spanning January to August 2023, domestic institutions of the Bank of China processed a noteworthy 8.29 trillion yuan in cross-border RMB settlements.

This figure reflects a substantial 22% year-on-year increase, accounting for nearly a quarter of the market share. The Bank of China has maintained its prominent position in the industry. Notably, cross-border RMB settlement transactions between domestic institutions and Belt and Road countries experienced a significant year-on-year surge, reaching 919.485 billion yuan.

Among these transactions, cross-border RMB settlements between domestic institutions and co-establishment countries within the Belt and Road initiative represented an impressive year-on-year growth of 27.16%. Furthermore, Bank of China’s overseas institutions managed cross-border RMB settlement transactions marked a 4.45% year-on-year increase. Notably, institutions within Belt and Road countries processed 572.852 billion yuan in cross-border RMB settlements, showcasing a remarkable 90.41% year-on-year increase.

There is a concerted effort to optimize the RMB’s investment and reserve capabilities. As China’s financial market continues to open up, RMB-denominated assets have gained increased appeal among global investors.

The Bank of China has been proactive in enhancing its offerings for overseas investors, delivering a comprehensive suite of services including bond investments, currency exchange, hedging, and secure custody solutions.

A noteworthy milestone was achieved in 2022 when the Bank of China’s Nairobi Representative Office facilitated the purchase of RMB-denominated bonds by Kenya’s central bank. This move effectively integrated RMB assets into the country’s foreign exchange reserves, marking a significant stride in strengthening the RMB’s position on the global stage.

Total issuance of bonds: USD 14.5 billion

It’s noteworthy that Bank of China stands out as the financial institution with the highest number of Belt and Road themed bond issues, boasting the largest scale, broadest scope, and diverse range of currencies.

From 2015 to 2019, Bank of China successfully launched five issues of Belt and Road themed bonds, totaling an impressive USD 14.5 billion across seven currencies, including renminbi, U.S. dollars, and euros.

In the realm of green bonds, Bank of China achieved a significant milestone in September of this year by successfully issuing the world’s inaugural batch of Belt and Road themed green bonds.

Since 2013, Bank of China has been steadfast in its commitment to aiding Belt and Road countries and affiliated institutions in issuing Panda bonds to raise essential funds. Remarkably, Bank of China has held the top position in the market for Panda bonds for an impressive 10 consecutive years, maintaining an average annual market share exceeding 25% and encompassing all current issuers.

The bank has played a pivotal role in facilitating the issuance of Panda bonds for countries such as Poland, Hungary, Portugal, and the Emirate of Sharjah within China.

Concurrently, it has extended its assistance to several multilateral organizations including the Asian Infrastructure Investment Bank, the Asian Development Bank, and the New Development Bank, in issuing Panda bonds to bolster regional development. As of the first half of 2023, Bank of China has aided these organizations in issuing a total of 29 Panda bonds, amounting to RMB 75.960 billion.

In terms of foreign debt, by the close of the first half of 2023, Bank of China had cumulatively supported sovereign institutions in countries including Saudi Arabia, with total bond issuances amounting to USD 47.902 billion. Additionally, issuers in countries such as Singapore, Kazakhstan, the United Arab Emirates, Hungary, and others have collectively issued credit bonds totaling USD 48.584 billion.

Solid risk management In the process of supporting the Initiative

Yan Haisi, Deputy General Manager of Bank of China’s Corporate Finance Department, emphasized the importance of maintaining a prudent yet dynamically responsive approach to country-specific risks.

He highlighted the necessity of closely monitoring the evolving situations in countries involved in the Belt and Road initiative. This includes enhancing the scientific nature of investment and financing decisions, as well as elevating the level of debt management.

For instance, in countries rich in oil, an in-depth evaluation of country risk considers leading industries, key enterprises, and the international financial economy linked to the prices of essential commodities for robust medium and long-term risk assessment and product portfolio design.

Furthermore, Yan Haisi outlined four additional main principles for risk control at Bank of China:

Prioritize commercialization and marketization principles, ensuring meticulous due diligence, financing structure design, and loan agreement drafting of high quality. Simultaneously, provide financial services such as project consulting and structural design to support the high-quality construction and operation of relevant projects.

Leverage China’s expertise in international business, utilizing product services and risk management tools, including capital trading, value preservation, and hedging. This facilitates more effective management of risks associated with interest rate and exchange rate fluctuations, thereby establishing a solid foundation for project stability and success.

Harness China’s professional proficiency and market influence in the realm of syndicated loans. This not only diversifies financing risks but also guarantees the alignment of returns and risks through expert syndication services.

Foster robust collaboration with international organizations and other professional entities. This entails leveraging their specialized strengths to provide risk mitigation, market information, and risk management strategies for projects and enterprises. Additionally, through innovative cooperative models, encourage joint participation, risk-sharing, and mutual benefits among all stakeholders.

(Source: Bank of China, 21th century business herald, essential business, Caixin Global)