The EU Battery Regulation in force for nearly seven months, mandates that all batteries sold or used in the EU meet sustainability criteria. Stemming from the EU’s Green Deal, this legislation underscores the EU’s commitment to fostering a circular economy and bolstering its strategic control over batteries and vital mineral resources. Consequently, Chinese power battery manufacturers face considerable pressure.

What obstacles does the EU Battery Bill pose?

The requirement for battery carbon footprint within the Battery Regulation garners significant attention among its provisions. It marks the first instance of carbon footprint becoming a mandatory requirement within EU policies and regulations, with the carbon footprint statement being a primary stage requirement.

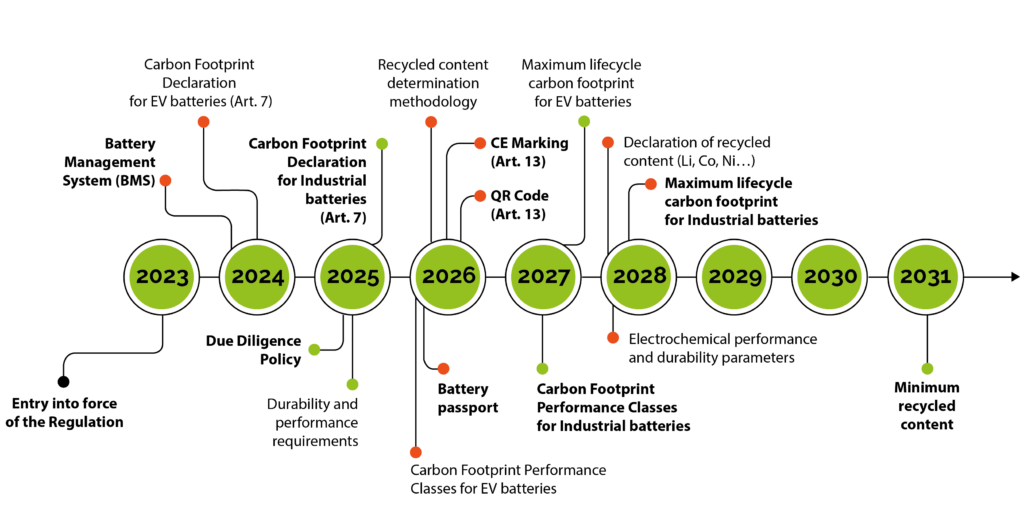

As per the Battery Regulation’s stipulations, rechargeable industrial batteries, light vehicle batteries (LMT), and power batteries exceeding 2 kWh capacity must be accompanied by a carbon footprint statement no later than February 18, 2025.

Simultaneously, the EU is studying performance levels and thresholds for battery carbon footprint. Starting from August 18, 2026, battery products will carry a carbon footprint performance class label, and from February 18, 2028, entry into the EU market will be prohibited for products exceeding the maximum carbon footprint threshold.

To ensure consistency in battery assessments, the European Commission’s Joint Research Center (JRC) is developing rules for calculating the carbon footprint of power batteries (CFB-EV). In June 2023, the JRC released the final draft of these calculation rules, covering methodology, modeling methods, documentation and verification requirements, functional units, life cycle assessment system boundaries, primary and secondary life cycle inventory data utilization, environmental performance, and verification procedures. The final calculation rules are expected to be released in the first half of 2024.

Prior to and after the new Battery Regulation’s release, Chinese power battery manufacturers generally reported heightened pressure in battery carbon footprint reporting. Challenges included tight time requirements, limited experience in relevant work, and a relatively thin supply chain database. Some manufacturers’ trial calculations revealed higher carbon footprints for domestically produced power batteries compared to similar products from Europe, Japan, and South Korea. In the EU’s vigorous promotion of green development, power batteries may pose significant hurdles to business expansion in Europe.

The core of battery carbon footprint calculation

Many manufacturers highlight the electricity carbon footprint as the most challenging aspect of carbon footprint accounting to reduce and overcome. Understanding electricity carbon footprint involves considering the full life cycle carbon emissions, encompassing raw material production, transportation, power generation, transmission, and distribution. Currently, China hasn’t published an official national average electricity carbon footprint dataset.

In the draft calculation rules, electricity carbon footprint calculation begins with electricity modeling. Based on the modeling outcomes, carbon footprints of electricity from various sources are computed and allocated to products. Traceability is crucial in electricity carbon footprint calculation, where the type of electricity used is identified, carbon footprints of different electricity types are determined, and a total electricity carbon footprint is calculated.

According to the current JRC draft, there are four power models in priority order:

1. On-site power generation

2. Vendor Specific Power Products

3. Remaining consumption mix

4. Average consumption mix

On-site power generation, being the first priority in accounting, exerts minimal pressure or impact on power battery manufacturers. This is because most on-site power generation projects in China are self-built distributed renewable energy projects, characterized by relatively low carbon footprints. Additionally, on-site power generation typically meets less than 10% of production electricity needs, with the remainder procured externally. Thus, reducing the carbon footprint of purchased electricity becomes paramount.

For outsourced power, the JRC draft outlines three modeling types: supplier-specific power products, residual consumption portfolio, and average consumption portfolio. Supplier-specific products refer to traceable electricity purchased directly from suppliers, while residual power portfolio encompasses the remaining power mix excluding traceable sources. The JRC requires contract instruments used for supplier-specific product modeling to meet specific criteria, with the Guarantee of Origin (GO) system recognized as meeting minimum standards. However, China’s Green Certificate (GEC), while close to meeting JRC requirements, lacks cancellation and invalidation processes and a published residual power portfolio.

Using the national average electricity consumption mix for modeling, especially given China’s high reliance on coal power generation, would significantly elevate the carbon footprint of domestically produced power batteries compared to those from Japan and South Korea, where cleaner energy sources dominate.

Failure to address electricity carbon footprint adequately may severely impact China’s battery industry competitiveness. Utilizing green certificates and traceability systems, particularly those using renewable energy sources, could improve China’s position in the EU market.

Continuous improvement of the green certificate system and timely updating of power generation structure data are essential steps. Maintaining communication with databases and certification agencies will help bridge information gaps and support ongoing efforts to reduce the carbon footprint of electricity.

EU carbon footprint accounting rules are just the starting point

While the access carbon footprint level and threshold requirements may be a few years off, the mandatory carbon footprint declaration starting in 2025 raises immediate concerns. If Chinese battery products exhibit higher carbon footprints than those from other countries, manufacturers fear criticism for being insufficiently green. This could lead to losing customers from car factories, with competitors from Japan, South Korea, and Europe quickly catching up. Consequently, China’s advantage in the power battery industry chain may diminish.

This means power battery manufacturers have less than a year to address these challenges. To mitigate risks, some are actively engaging with stakeholders, seeking technical and policy support. Others contemplate relocating factories overseas, particularly in the EU, to address carbon footprint concerns.

However, overseas factory construction poses drawbacks for both enterprises and domestic economic development. While it may resolve carbon footprint issues, it exposes companies to localization policy risks and increases production costs. Moreover, relocating production capacity overseas isn’t favorable for local economic development. Thus, both companies and governments prefer to maintain production in China.

Of particular concern is the EU’s impending textile carbon footprint regulations. The Ecological Design of Sustainable Products Directive (ESPR) includes requirements for product carbon footprint and environmental footprint, prioritizing textiles, especially shoes and clothing. As China is the EU’s largest source of textile and apparel imports, ESPR implementation could impact Chinese exports. Textile and apparel manufacturers have voiced similar concerns about weak data infrastructure and policy uncertainties.

Overall, the pressure from carbon footprint regulations extends beyond the power battery industry, affecting other sectors like textiles and apparel. Strengthening data infrastructure and enhancing policy connectivity are crucial for navigating these challenges effectively.

(Source: Flash Battery, CIC energiGUNE, Plutonic Raw Materials)