Last month, the U.S. District Court for the Northern District of California announced that China’s Yangtze Memory had sued Micron Technology and its wholly-owned subsidiary Micron Consumer Products Group for the infringement of eight U.S. patents on 3D NAND technology used in the latter’s solid-state drive products.

NAND Flash and DRAM are currently the two most important storage media. NAND Flash can be used to manufacture memory, such as SSDs, which are utilized in cell phones, servers, PCs, and other products.

In the complaint, Yangtze Memory alleges that Micron’s unauthorized use of Yangtze Memory’s patented technology to compete with and protect its market share, along with Micron’s failure to pay reasonable fees for the use of said patents, infringes onYangtze Memory’s interests and curtails the latter’s incentive to innovate. It also alleges that Micron cited Yangtze Memory-related patents in its own patent documents, proving that Micron understands that Yangtze Memory’s patent portfolio is crucial. However, Micron has not taken any practical action to seek authorization for Yangtze Memory’s patents.

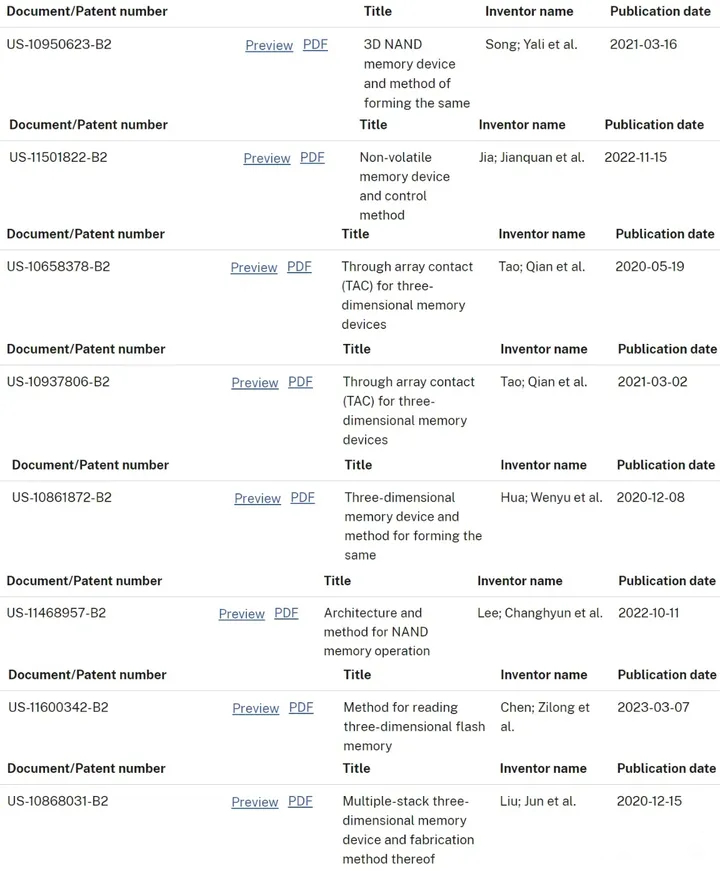

It is reported that the current case involving Yangtze Memory patents includes: US10950623, US11501822, US10658378, US10937806, US10861872, US11468957, US11600342, and US1086803. Micron is accused of infringing on 96-layer, 128-layer, 176-layer, and 232-layer 3D NAND products.

Yangtze Memory is the largest 3D NAND Flash manufacturer in China. Founded in July 2016, the company is an IDM IC company that specializes in the integrated design and manufacturing of 3D NAND flash memory, as well as providing complete memory solutions.

Yangtze Memory supplies 3D NAND Flash wafers and chips, embedded memory chips, and consumer and enterprise SSDs to its global partners for a wide range of products and solutions in mobile communications, consumer digital, computers, servers, and data centers.

There are two reasons why Yangtze Memory does have an advantage in 3D NAND technology.

First, Yangtze Memory chose to join the development of 3D NAND technology at a point in time when the development of traditional planar NAND Flash technology came to an end, and all the mainstream international manufacturers were moving to 3D NAND technology. This transition represents an important turning point in the development of NAND Flash technology.

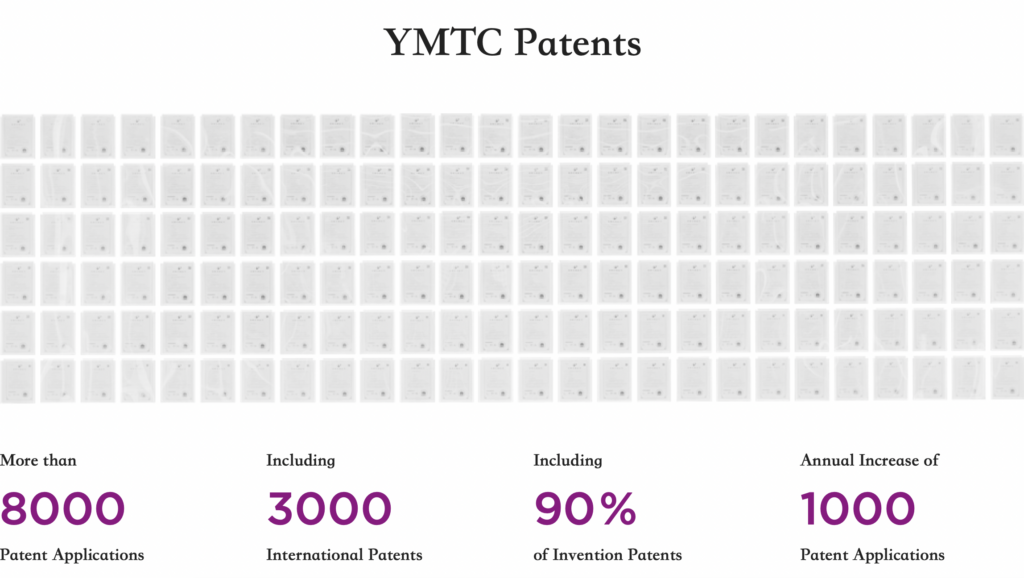

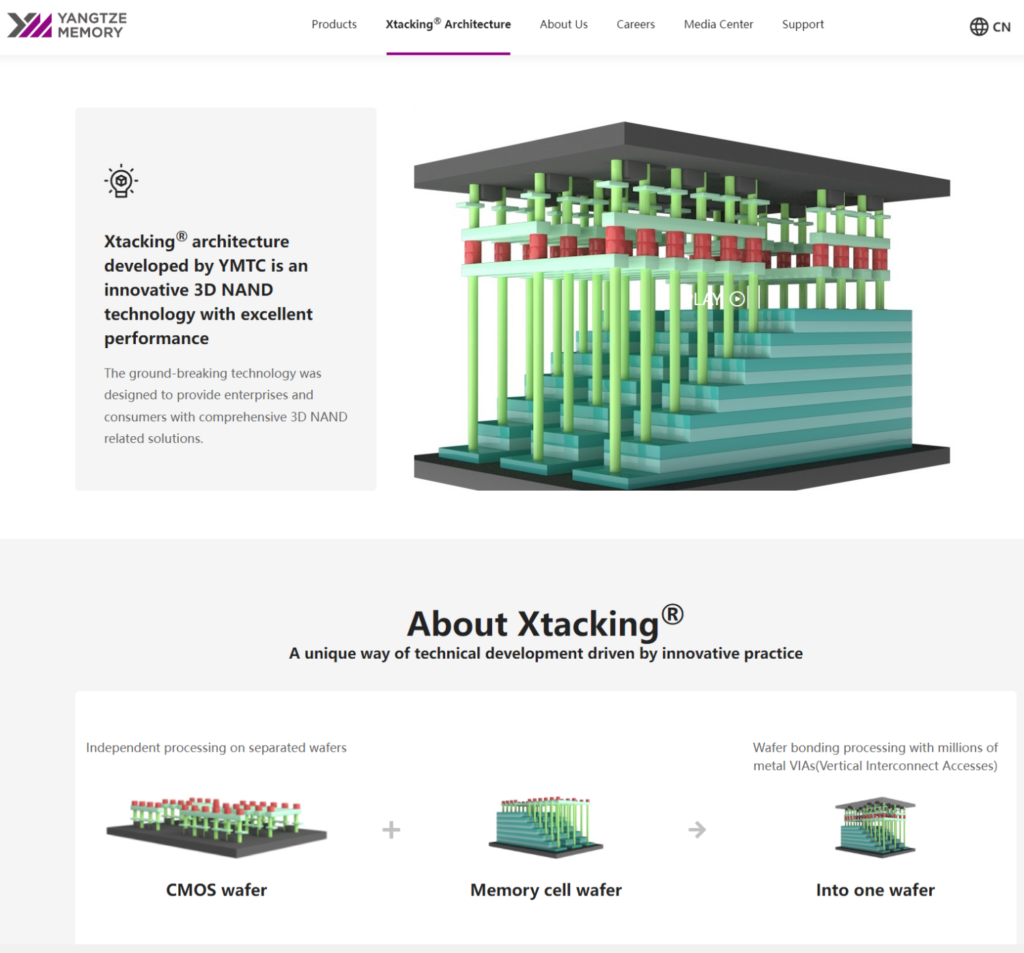

The second advantage is the success of Yangtze Memory’s exclusive Xtacking technology, which has not only gained patent protection but has also allowed 3D NAND technology to quickly catch up with the international major players. The Xtacking technology has already been developed into the Xtacking 3.0 architecture.

There were rumors that many international storage companies, including Korean chip companies, were so interested in details of Xtacking technology that they would not rule out cooperating with each other in the form of technology cross-licensing.

In the indictment, Yangtze Memory pointed out that the brand is already an important player in the global 3D NAND field. Last November, market research firm TechInsights, stated that Yangtze Memory’s technology has already surpassed Micron’s.

In October 2022, the Bureau of Industry and Security of the U.S. Department of Commerce issued new export control regulations, restricting the export of chip manufacturing equipment and other equipment to China.

Before the U.S. imposed export controls on Yangtze Memory in October 2022, the company’s 128-layer 3D NAND chips had already entered Apple’s supply chain. Apple recognized these chips for their technology and quality and intended to use them in iPhones sold in the Chinese market.

These restrictions affected the number of layers of Yangtze Memory’s NAND Flash chips in the latest process that had been mass-produced. At that time, Apple also sought to adopt Yangtze Memory 3D NAND chips to reduce cost and avoid dependency on flash memory chips from Samsung, SK Hynix, and Micron. However, in December 2022, Yangtze Memory was added to the export control entity list, so Apple had to turn to other 3D NAND suppliers for its goods.

It is worth mentioning that, in addition to this complaint in the US, in May of this year, the Cyberspace Administration of China released a directive stating that, in accordance with Chinese Cybersecurity Law, domestic critical information infrastructure operators should cease purchasing Micron products.

Industry sources point out that the real purpose of Yangtze Memory initiating this patent war is to secure a fair negotiation for the company amidst the U.S. export control blockade, essentially fighting for the company’s survival.

Yangtze Memory also mentioned in the indictment that if the court fails to grant a permanent injunction on Micron’s products based on patent infringement, alternative measures should be explored. For instance, Micron could be required to pay a patent license fee to Yangtze Memory.

However, given the current semiconductor competition between the U.S. and China amid escalating tensions, the lawsuit’s symbolic significance in the broader context of U.S. companies facing challenges in China is likely more pronounced than its practical significance.

(Source: Yicai, EET China, YMTC, U.S. District Court for the Northern District of California)