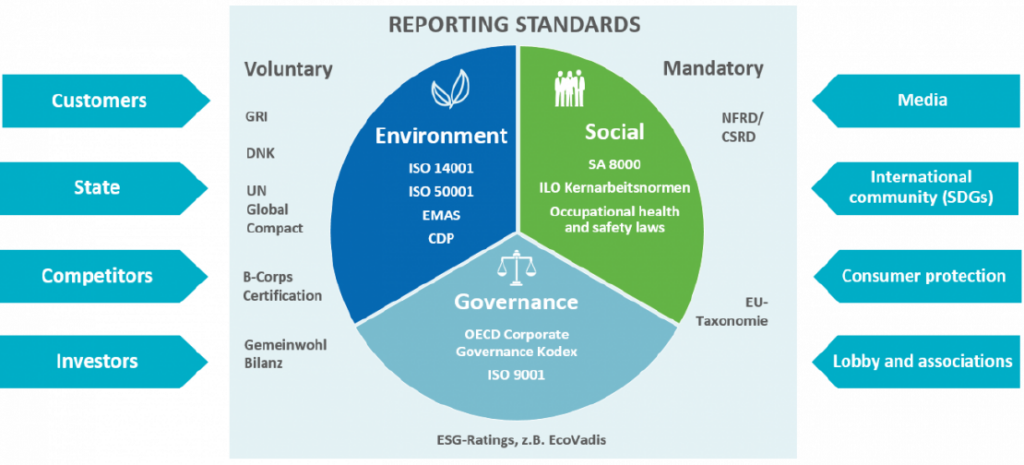

With the increasing interest in environmental, social, and corporate governance (ESG) among global society, governments, and regulators, the Corporate Sustainability Reporting Directive (CSRD), the latest cornerstone regulation on ESG disclosure in the European Union, is poised to set a new standard for companies to showcase their social responsibility and sustainability commitments on the global stage.

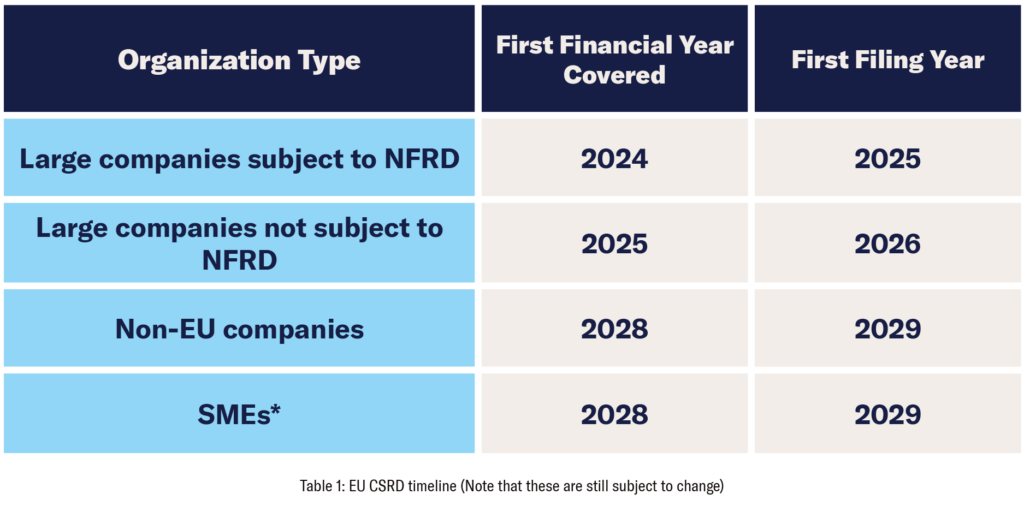

Effective from January 5, 2023, the CSRD mandates companies operating within the EU (including non-EU companies and eligible subsidiaries) to publicly disclose the environmental and social impacts of their business operations. Additionally, they are required to disclose the effects of their environmental, social, and Corporate Governance (ESG) initiatives on their business.

Approximately 50,000 businesses will fall under the purview of this legislation, subject to more rigorous and specific disclosure requirements. Against this backdrop, the CSRD is rapidly emerging as a more pivotal regulation than the GDPR, with far-reaching implications for business strategies, reputation management, and internal processes.

The CSRD was introduced to address the growing need for transparent and standardized reporting on ESG matters, thereby enhancing investor confidence, promoting sustainable business practices, and facilitating informed decision-making in financial markets.

In 2021, following an assessment of data gathered by the Non-Financial Reporting Directive (NFRD), the European Parliamentary Research Service (EPRS) identified several deficiencies, notably the absence of consistent and comparable data. These shortcomings could potentially hinder investments in sustainability and impose higher data costs on stakeholders.

The launch of the Corporate Sustainability Reporting Directive (CSRD) aims to address these issues by offering investors, analysts, consumers, and other stakeholders enhanced transparency. This facilitates a more comprehensive evaluation of the sustainability performance of EU companies, along with a deeper understanding of associated business impacts and risks. Embedded within the European Commission’s Sustainable Finance Program, the CSRD represents a crucial initiative by the EU to tackle global climate change and social issues.

Simultaneously, the implementation of the CSRD significantly broadens the scope of disclosure and reporting requirements compared to its predecessor, the Non-Financial Reporting Directive (NFRD). Consequently, companies will be compelled to provide more detailed information about their Environmental, Social, and Governance (ESG) practices to align with evolving societal expectations and regulatory mandates.

CSRD holds greater importance than GDPR due to its comprehensive disclosure requirements and emphasis on sustainable development. Unlike GDPR, which primarily focuses on personal data protection, CSRD mandates companies to adhere to dual materiality standards. This entails reporting not only on the impact of their activities on people and the environment but also on the financial implications for business operations. This holistic approach necessitates a deeper understanding of environmental and social impacts, aligning them with financial performance.

The implementation of the dual materiality standard under CSRD marks a significant shift, compelling companies to assess their operations from a broader and deeper perspective. Consequently, CSRD’s disclosure requirements are more extensive compared to GDPR, encouraging enterprises to actively engage in sustainable practices. This proactive stance not only fosters responsible corporate behavior but also enhances long-term competitiveness.

While GDPR imposes fines for non-compliance, CSRD’s repercussions extend beyond financial losses. Failure to comply with CSRD may result in direct legal consequences, as EU member states are mandated to establish investigation and compliance entities. These entities are empowered to levy sanctions ranging from fines to restrictions on business operations, and in severe cases, even revocation of operating licenses. It is imperative for compliant companies to stay abreast of legal developments and seek legal counsel to mitigate the risk of investigations and penalties.

In addition to the legal ramifications, non-compliance with CSRD entails various financial implications that warrant careful consideration. Failure to adhere to sustainability regulations can lead to increased business costs and diminished revenue. With investors increasingly prioritizing corporate sustainability and ESG issues, a lack of transparency and poor sustainability practices may deter potential investors, reducing a company’s access to funding. Moreover, non-compliance may result in elevated insurance costs, as insurers perceive companies failing to meet sustainability standards as riskier to insure.

One of the most significant consequences of non-compliance with CSRD is damage to a company’s reputation. In today’s society, transparency and corporate responsibility are highly valued by consumers, employees, investors, and competitors alike. Failing to comply with CSRD not only tarnishes a company’s image but also erodes trust, leading to decreased customer loyalty, challenges in attracting and retaining top talent, and negative public perception that directly impacts the bottom line.

Non-compliance also presents serious operational hurdles. Embracing sustainable development practices can enhance efficiency, spur innovation, and confer competitive advantages. Conversely, companies neglecting these practices risk lagging behind more forward-thinking competitors.

Furthermore, failure to comply with regulations like CSRD can hinder future business opportunities. Many government agencies and large enterprises mandate suppliers to adhere to sustainable development principles, making strict compliance essential for forging business partnerships. Consequently, non-compliance may constrain a company’s ability to secure lucrative contracts and partnerships, thereby impeding its growth prospects.

To comply with CSRD, companies must gather and integrate substantial amounts of data. A robust foundation in ESG and DEI data can facilitate streamlined reporting, aid in audits of CSRD disclosures, and better equip organizations to adapt to the forthcoming changes from 2024 onwards.

The implementation of CSRD has presented unprecedented challenges for many Chinese companies operating in Europe or seeking to expand into the EU market. As it takes effect in 2024, Chinese companies listed or issuing bonds in the EU with an annual net turnover exceeding €150 million, as well as those with subsidiaries or branches in Europe, must carefully assess whether they need to comply with CSRD disclosure requirements. To prepare in advance, these companies must thoroughly understand regulatory mandates and take appropriate measures. For businesses that have historically under-disclosed in these areas, this may necessitate systemic changes and adjustments.

Moreover, CSRD mandates companies to disclose value chain information, including when the value chain extends outside the EU. This requirement will significantly impact a company’s supply chain strategy and partner selection. European companies importing products directly from China may prioritize collaborating with manufacturers demonstrating robust ESG disclosure. This trend will incentivize Chinese companies to bolster their environmental, social, and governance management, enhancing overall sustainability and transparency levels.

Additionally, while Chinese subsidiaries of European companies are theoretically not subject to CSRD, leading European firms may integrate CSRD requirements into their Chinese subsidiary management processes. This could result in heightened scrutiny of ESG and DEI management levels among local Chinese suppliers. Consequently, Chinese suppliers with mature ESG and DEI practices may stand out, gaining more business opportunities and partners.

These shifts will not only impact Chinese companies in the European market but also influence the entire cross-border supply chain ecosystem. Companies must proactively understand CSRD and prepare for compliance to remain competitive and expand market share.

For Chinese overseas companies, closely monitoring CSRD implementation is not only necessary for cross-border compliance but also a strategic approach to seize market opportunities. By establishing sustainable business models and management systems, these companies can mitigate potential business risks and uncover new growth opportunities in an international market increasingly prioritizing sustainable development.

(Source: Ecometrica, cloudopex)