Being adept at reflection and review is a vital skill, embodying an individual’s, a collective’s, and an important emblem of a society’s progress towards maturity. Without it, one is destined to repeatedly stumble into the same pitfalls.

The European Commission initiates a countervailing investigation into China’s new energy vehicles. This echoes their previous misstep in the photovoltaic industry, which resulted in a significant loss.

The China-EU photovoltaic dispute commenced in 2012 and concluded on August 31, 2018, when the European Commission proactively announced that it would not renew the double reverse measures on China’s solar panels after their expiration on September 3.

The EU’s imposing tariffs of 47.7-64.9% on Chinese PV modules, along with the obligatory enforcement of minimum price agreements, artificially elevate the cost and price of photovoltaic products. This inevitably leads to curtailed plans for purchases by consumers and investors, or in some cases, cancellations. Consequently, there is a sharp downturn in demand for the European PV market.

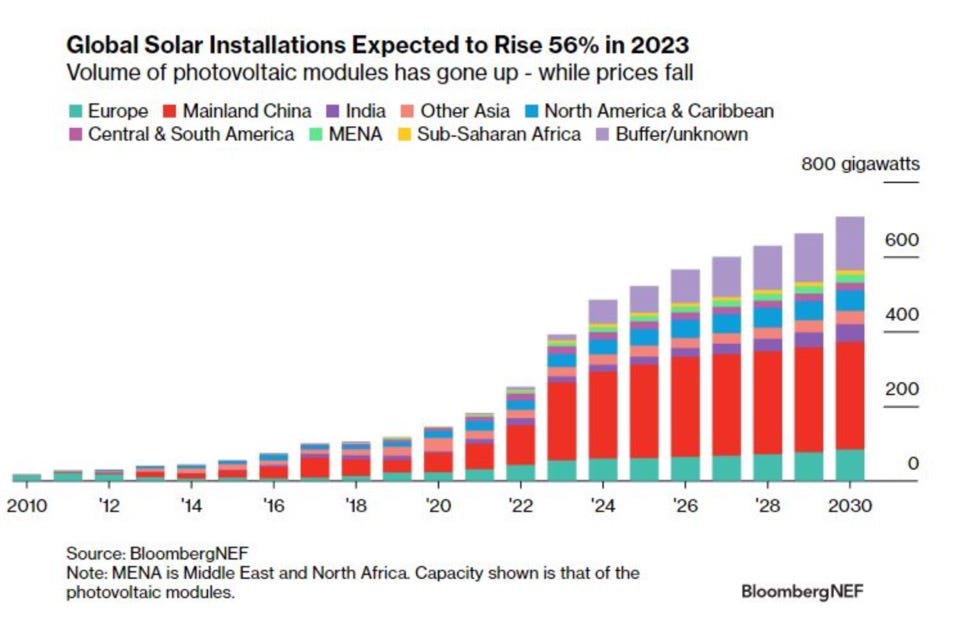

In 2012, the EU’s 27 member countries collectively achieved an impressive new photovoltaic installed power generation capacity of approximately 17.7 gigawatts, making them the global frontrunners. However, by the end of 2018, this figure had plummeted to 8 gigawatts. This decline caused the EU to permanently relinquish its position as the world leader in the solar energy industry, with China, the United States, and Japan surging ahead. In the tumultuous year of 2016, the capacity even dropped to around 4 GW, regressing to levels last seen in 2007.

The EU’s protective measures, designed to shield European photovoltaic enterprises from competition, inadvertently impede the industry’s capacity for innovation and growth. This constitutes the first critical lesson that the European Commission ought to reflect upon in terms of market dynamics.

On May 24, 2013 when the European Union held a vote on whether to impose high tariffs on Chinese photovoltaic products. Among the 27 EU member states, including Germany, Britain, and the Netherlands, 18 member states voted against, with only four countries in support and five abstaining.

Logically, based on this outcome, the European Commission should have ceased to push forward this unpopular anti-market program. However, due to the formidable power vested in the European Commission by the EU’s organizational procedures, the collective opposition of multiple member states did not deter its progress.

Shortly after the vote, the European Commission proceeded to implement temporary anti-dumping duties. Ultimately, after strenuous negotiations, both China and the EU reached an agreement to adopt a settlement program involving price commitments and export quotas. Out of the 134 Chinese enterprises investigated, 94 were released from the imposition of double anti-duties upon participating in the program. However, enterprises that chose not to partake in the program continued to face levies.

The guiding principle of the European Commission should be to seek and expand common interests in Europe through dialogue and compromise, rather than sacrificing the interests of the majority of member states to appease a small faction or interest groups.

Who delivered the final blow to European companies, already struggling amidst the market downturn in 2017-2018? It was the U.S. government.

In January 2018, the Trump administration announced an across-the-board tariff of up to 30% on solar modules and cells not manufactured in the U.S., invoking Section 201 of the Trade Act of 1974. This move effectively snuffed out the remaining hope for European PV manufacturing companies.

Ironically, Trump echoed the very same slogan that the EU initially championed—to shield domestic industries from what they deemed as unfair competition from foreign products.

Even more ironically, in the February 2018 discussions between the U.S. and Europe, the U.S. government swiftly dismissed the EU’s plea for a tariff exemption, despite the fact that the EU had initially coerced China into accepting price commitments and export quotas. This led to an immediate breakdown in negotiations.

On March 28, 2018, SolarWorld, the largest vertically integrated solar energy company in Europe and a key proponent of the year’s double reverse investigation against China, found itself unable to rescue its own operations. It filed for bankruptcy, bringing an end to decades of illustrious history and sending shockwaves throughout the global industry.

The EU could have chosen to collaborate with China and the U.S. government on market countermeasures. However, due to short-sighted decision-making, these possibilities were rendered ineffectual.

None of these three lessons arise from China’s supposed “unfair trade” practices. In fact, such behavior holds no positive implications for Europe whatsoever.

Following the earlier turbulence in the PV subsidy landscape, China engaged in a thorough reevaluation. As a result, subsidies for new energy vehicles were implemented with careful oversight.

In 2019, China implemented a series of adjustments and reforms within the new energy vehicle industry. These included a gradual reduction in purchase and usage subsidies, encouraging companies to enhance cost-efficiency through technological advancements and market competition. Additionally, there was a reinforcement of quality and safety management regulations for new energy vehicle products.

This encompassed standardizing certification, testing, standards, recycling, and other aspects of new energy vehicle products. The initiative also extended support for the development and operation of new energy vehicle infrastructure. This involved expediting the establishment of facilities and technologies such as charging stations, power exchange points, 5G, and smart technologies.

Guided by these policies, China’s new energy vehicle industry has transitioned onto a robust and sustainable developmental trajectory. Products within this industry have seen continual improvements in safety, technological sophistication, design standards, and service quality, ultimately earning recognition in the market.

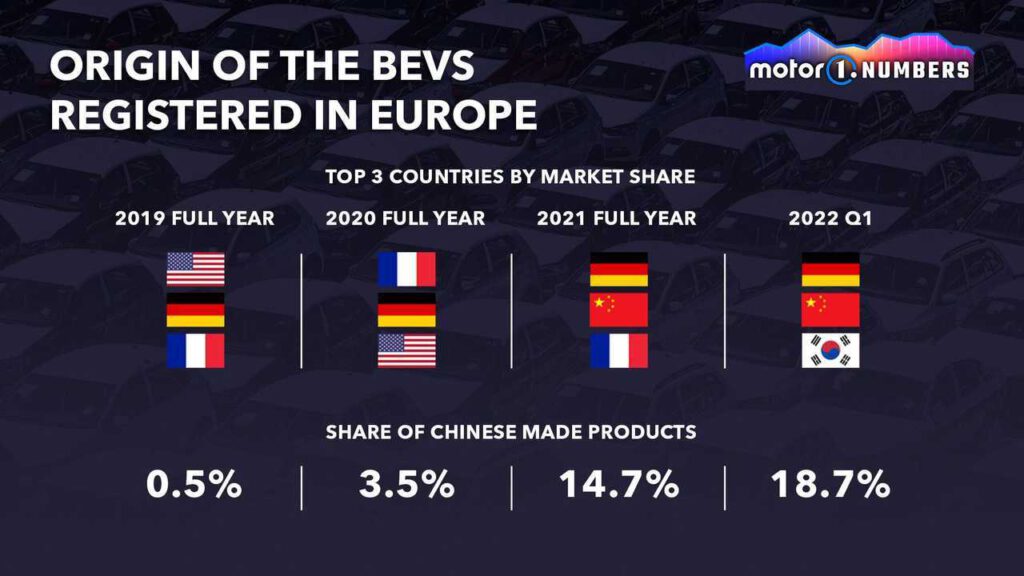

As highlighted in a statement by the EU-China Chamber of Commerce on the day von der Leyen announced the investigation, Chinese electric vehicles (EVs) and the entirety of the upstream and downstream industry chain have cultivated a comprehensive industrial advantage within the fiercely competitive Chinese market. This edge is not solely attributed to what’s often referred to as substantial subsidies.

Furthermore, the European automotive industry encompasses millions of employees engaged in sales, maintenance, and repair across the middle and lower tiers. The potential impact on these workers would likely compel the EU to reconsider such actions.

Reflecting on the past, SolarWorld spearheaded the formation of a European Solar PV Alliance to advocate for the double reverse investigation. Sensing that this confrontation could potentially harm the development of the European Solar PV Alliance, manufacturers in sales, accessories, and installation promptly counteracted these efforts.

For instance, in April 2013, the Association for Applied Solar Energy (AFASE) mobilized over 700 enterprises throughout Europe to issue a 27-page open letter to the European Commission. This letter explicitly pointed out that the Manufacturers Alliance lacked the qualifications to represent the industry and emphasized that sanctions on Chinese products would result in irreparable harm to the EU.

The current situation in the automotive industry mirrors past patterns. Specifically, the midstream and downstream sectors are generally hoping for high-quality, cost-effective new energy products to stimulate users to expedite their vehicle replacement plans. This, in turn, would lead to an expansion of the automotive market and an enhanced bargaining position with traditional car manufacturers.

Considering that the European automotive industry employs a staggering 14 million people, with 11.5 million engaged in midstream and downstream segments, if this bloc were to rally against the EU in trade friction, Brussels must carefully consider its response. What conditions must be met for the EU to take action?

Should the EU choose to proceed in this manner, it must be prepared for the potential surge of anti-EU extreme right-wing political parties. This could lead to a host of challenges far beyond just the trade dispute with China.

Ultimately, it’s not the Chinese cars that the EU may end up affecting, but rather the future of Europe itself.

(Source: Motor1, les echos, Medium)