On May 23, according to the official website of the Hong Kong Securities and Futures Commission, the previous consultation period regarding the proposed regulatory requirements applicable to operators of compliant virtual asset trading platforms in Hong Kong ended on March 31, with respondents generally supporting the proposed regulatory requirements applicable to licensed virtual asset trading platforms.

The Hong Kong Securities and Futures Commission said the revised proposed regulatory requirements will take effect on June 1. Meanwhile, the SFC said responders expressed strong support for allowing licensed virtual asset trading platforms to offer services to retail investors. The SFC will implement the proposal to allow licensed virtual asset trading platforms to provide services to retail investors. However, these currencies must meet certain strict criteria to qualify for trading.

“Providing clear regulatory rules is the only way to promote responsible development. Hong Kong’s comprehensive regulatory framework for virtual assets follows the principle of ‘same business, same risk, same rules’ and aims to provide proper investor protection and manage key risks, thereby promoting sustainable industry development and supporting innovation.” said Ms. Julia Leung Fung-yee, Chief Executive Officer of the Hong Kong Securities and Futures Commission.

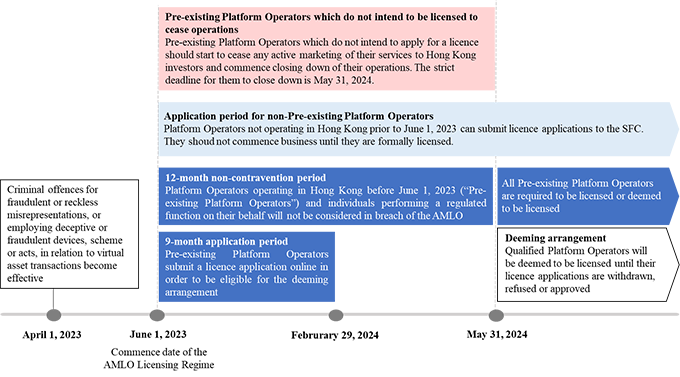

The HKSFC said it welcomes applications for licenses from operators of virtual asset trading platforms that are ready to comply with the HKSFC’s standards, while operators that do not intend to apply for a license are required to wind down their operations in Hong Kong in an orderly manner. At the same time, the HKSFC highlighted that it has not yet approved any virtual asset trading platforms to provide services to retail investors and that most of the existing publicly accessible virtual asset trading platforms are not regulated by the HKSFC.

So far, two cryptocurrency companies have licenses to conduct compliant transactions in Hong Kong: OSL Exchange, a subsidiary of BC Technologies, and HashkeyPro Exchange, a subsidiary of Hashkey that is not yet live. Under the new policy, both trading platforms will also need to apply for a new VASP license with a simplified application process.

Only ten cryptocurrencies meet the criteria, including: Bitcoin, Ethereum, Litecoin, Polkadot, Bitcoin Cash, Solana, Cardano, Avalanche, Polygon, and Chainlink.

To be allowed to trade on a retail basis, cryptocurrency tokens must meet the strict rules of the SFC. First, tokens must have at least 12 months of regulatory compliance. During this period, the projects to which these tokens belong should not be subject to any criminal charges. On the other hand, the tokens must be on the investable indices of at least two major independent investment firms. Tokens that do not meet these requirements will not be eligible for trading.

This new initiative marks an important step forward in the development of cryptocurrencies in Hong Kong. With this selective approach, Hong Kong hopes to strengthen its position in the global cryptocurrency market while maintaining a strict regulatory mark.

The strict criteria for token selection mean that many cryptocurrencies will be inaccessible to retail investors in Hong Kong. Given the growing popularity of stablecoins, excluding them from the approved list could be a missed opportunity.

Currently, Hong Kong, China has become one of the more cryptocurrency-friendly regions in the world with a high degree of regulatory certainty. On October 31, 2022, the Hong Kong SAR Government officially launched the “Policy Statement on Development of Virtual Assets in Hong Kong” at the Hong Kong Fintech Week, setting out the Hong Kong Government’s policy position and approach for the development of a vibrant virtual assets industry and ecosystem in Hong Kong. Prior to this, the Hong Kong government had stated its intention to become a global virtual asset hub.

HKSFC has taken a gradual approach to the liberalization of cryptocurrency policy. In this announcement, the regulator also proposed that stablecoins, which are cryptocurrencies linked to the value of other assets, “should not be allowed to be traded at retail” until the jurisdiction’s planned regulation for the asset class comes into effect.

For retail investors in Hong Kong, this development provides an opportunity to enter the cryptocurrency market. The increased adoption rate will also have a positive impact on the cryptocurrency market as a whole.

In addition to this, regarding proprietary trading, the HKSFC agreed to allow third-party market makers to conduct market-making activities, but the current prohibition on proprietary trading is sweeping and even prohibits group companies of licensed virtual asset trading platforms from holding any positions in virtual assets. As a result, the HKSFC has amended the “Guidelines for Virtual Asset Trading Platform Operators” (VATP Guideline), to allow affiliates to conduct program trading through channels other than licensed virtual asset trading platforms.

Concerning other common services in the virtual asset market, such as earnings, deposits, and lending, licensed virtual asset trading platforms are not permitted to provide these services because the primary business is to act as an agent and provide counterparties to clients. Any other activities may give rise to potential conflicts of interest and require additional safeguards.

In other words, Hong Kong offers a regulatory path to compliance for cryptocurrency trading platforms, but the previously wildly successful business model of some trading platforms will not be allowed. And for retail investors, they will have the opportunity to learn about crypto assets up close and personal.

(Source: HKSFC, bloomberg, Gibson Dunn, TokenInsight)