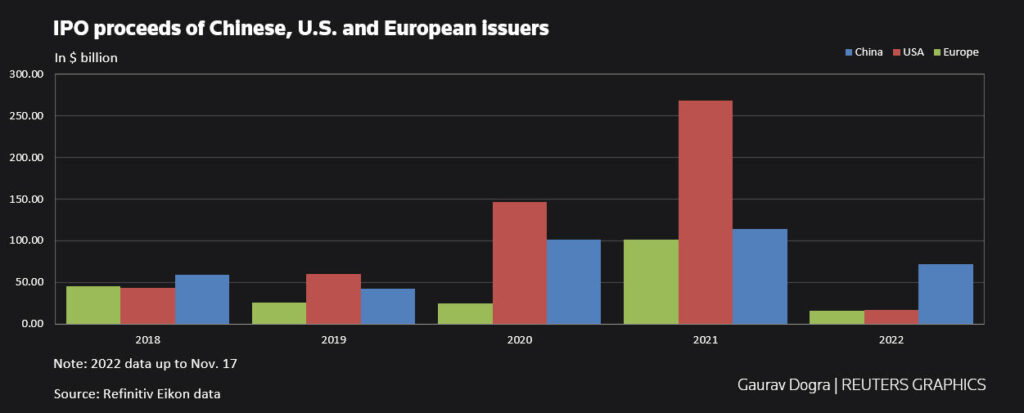

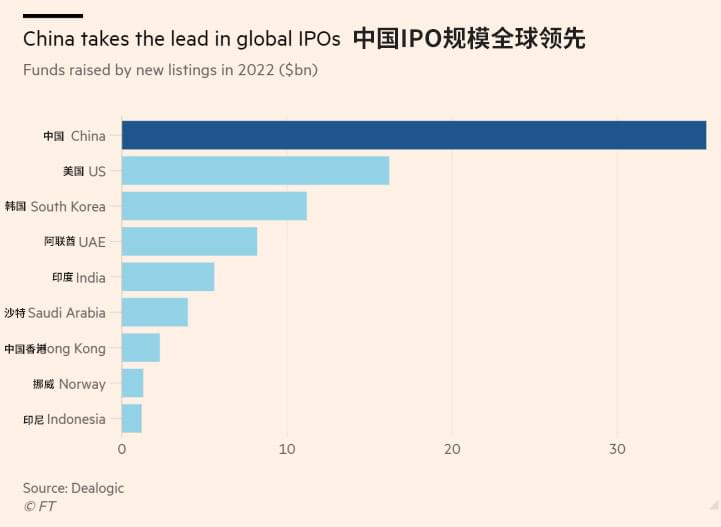

According to Bloomberg, in 2022, the IPO market in mainland China raised $92 billion, and its share of total global fundraising has soared to 46 percent, almost four times that of the U.S.

Growing China and downward European and US market

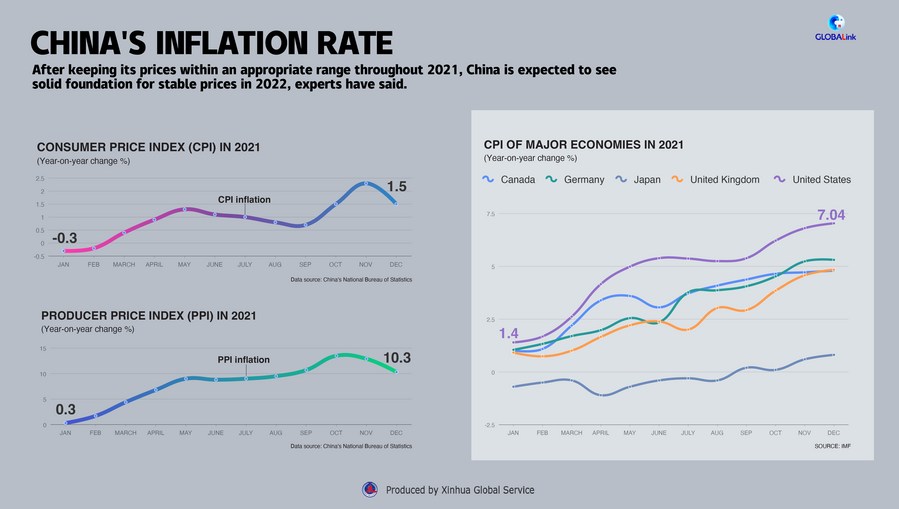

“Chinese markets are less affected by global volatility and, internally, China has lower inflation, more accommodative monetary policy, and more resilient stock market valuations,” said Mandy Zhu, head of global banking at UBS China.

While in the U.S., where the Federal Reserve began aggressively raising interest rates in 2022 as inflation became difficult to contain and analysts continued to warn of an impending recession. In the first half of 2022, U.S. GDP contracted for two consecutive quarters, and stock market volatility climbed as the market began to kill valuations for growth companies, and investors began to avoid high-growth companies, which are the main source of IPOs.

The European economy is also difficult. Most member economies fell into recession in the fourth quarter of 2022 due to multiple factors such as geopolitical tensions, soaring energy prices, pressure on household purchasing power, and tighter financing conditions, which bring more uncertainty for startups to go public and raise capital in 2023.

Meanwhile, the Chinese capital market is becoming more open and inclusive.

In recent years, the construction of China’s capital market has achieved a series of reform results, whether from the establishment of the Sci-Tech Innovation Board and pilot registration system to the reform of the registration system of the Growth Enterprise Market, and then the attempt to set up the Beijing Stock Exchange, which has formed a multi-level capital market system to adapt to the differentiated financing needs of enterprises of different types and stages of development, enhance the universality of services, broaden the inclusiveness and coverage of funds, and better provide timely capital support for enterprises at different stages of innovation.

China weighs more on technology and manufacturing power

Based on the number of IPOs in China, Second-board Market and Sci-Tech Innovation Board account for about two-thirds of the total number of A-share IPOs. Based on the amount of financing, Second-board Market and Sci-Tech Innovation Board rank first and second with more than 230 billion yuan and more than 170 billion yuan respectively, accounting for nearly 70% of the total financing of A-shares.

A large portion of these IPOs are by semiconductor, artificial intelligence, and business software startups, robotics companies, new energy companies, and other companies developing high-end technologies.

These phenomena show that science and technology innovation has been an important driver of China’s economic development, and enterprises with high-end manufacturing, scientific research achievements, and technological innovation as their core will become an important pillar of China’s future economic growth.

As of mid-November 2022, there were 123 Sci-Tech related companies listed on the Beijing Stock Exchange, with a total fundraising amount of 26.8 billion yuan and a total market value of nearly 200 billion yuan. Plus, they are mainly distributed in high-end equipment, new energy, science, technology software and hardware, new materials, and other fields.

The establishment of the Beijing Stock Exchange not only complements the key link of the Chinese capital market in helping SMEs to finance their development but also reflects the efforts and effectiveness of the construction of a multi-level capital market with Chinese characteristics, i.e. the realization of direct financing services for outstanding enterprises at different stages.

What are the charms of China?

With the optimization of China’s epidemic prevention and control policies, many foreign investors have recently expressed their bullishness on the Chinese market. Morgan Stanley economists have raised their expectations for China’s economic growth in 2023 from 5% to 5.4%.

In 2023, Chinese assets will remain highly attractive. First, from the macroeconomic policy point of view, China will still maintain a policy of maintaining stable growth, the Politburo Standing Committee of the Communist Party of China held in December pointed out that the active fiscal policy could increase the strength and efficiency, prudent monetary policy needs to be precise and strong, emphasizing to develop industrial policy and security at the same time, while focusing on self-reliance and self-improvement of science and technology policy and social policy to hold the bottom line of people’s livelihood.

Second, from the external environment, with the Fed’s successive rapid rate hikes leading to a downward spiral of U.S. economic momentum and even the risk of the recession may increase, the pace of subsequent rate hikes is expected to slow down, the phenomenon of cross-border capital outflows from China will improve, and the basic assumption that the U.S. dollar index will be weak in 2023, the RMB exchange rate is expected to steadily rebound, so the attractiveness of RMB assets will also be boosted.

(Source: Guancha, Reuters, Xinhua)