Since this March, the U.S. Silicon Valley Bank, Signature Bank, and First Republic Bank closed one after another, the banking crisis continues to ferment, and some regional banks’ share prices have plummeted this year.

The Federal Reserve reports that more than 700 U.S. banks are facing ‘significant safety and soundness risk’ due to large floating losses on their balance sheets and that these banks have reported losses of more than 50% of their capitals.

The collapse of banks such as First Republic Bank has heightened concerns about the solvency of regional banks, and investors have been selling financial stocks, causing the S&P 500 financial sector index to nearly fall below its 2007 peak. It took more than 10 years for the index to recover this position after the 2008 financial crisis.

U.S. Treasury Secretary Janet Yellen said the current banking environment and earnings pressures could lead to U.S. regulators opening to some degree of consolidation in several regional and mid-sized U.S. banks. If the U.S. Congress fails to act on the debt ceiling, it may trigger a “constitutional crisis” in the United States, negatively affecting the credit of the U.S. government. He believes that approval of debt issuance is the work and authority of Congress, and the only solution is Congress performing its duty to raise the debt ceiling. Otherwise, the White House and the U.S. Treasury Department have to invoke the 14th Amendment to the U.S. Constitution to usurp the power of Congress to issue debt on its own.

Out of concern for the economic outlook, credit quality, financing liquidity, and deposit outflows, 46% of U.S. banks plan to raise lending standards to reduce the risk banks take.

The U.S. banking industry is full of “real estate bad loans”

According to Goldman Sachs, the U.S. has $4.5 trillion in outstanding commercial/multifamily mortgages, 40% of which come from banks, or about $1.7 trillion, and regional banks account for about 65% of U.S. bank loans, while small and medium-sized banks account for about 80% of total commercial real estate loans, according to the Federal Deposit Insurance Corporation (FIDC).

In terms of debt maturity size, U.S. office debt maturity in 2023 is about $728 billion, and another $659 billion, 16% of total loans will mature in 2024.

During the period when the Federal Reserve maintains high-interest rates, refinancing conditions for real estate companies have deteriorated significantly and the risk of default may remain on an upward path.

U.S. government debt default is imminent

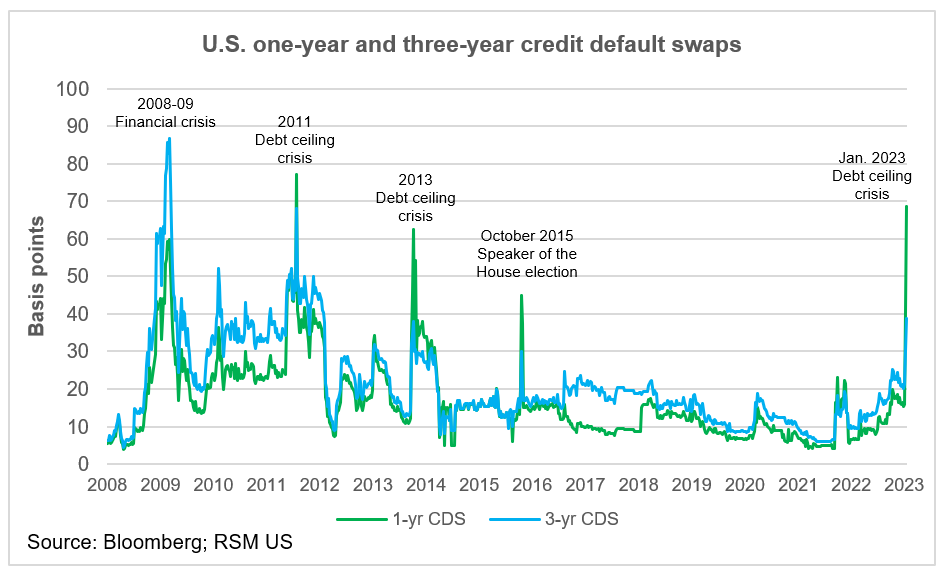

According to the current pace of federal borrowing, debt default may occur as early as June 1. Since 1993, the U.S. has temporarily raised the debt ceiling six times. But because of the serious political polarization in the U.S., the current risk of raising the debt ceiling is greater than ever.

According to the U.S. Treasury Department, as of May 10, the balance of special measures used to pay government bills remained $ 88 billion, a week ago the figure was $ 110 billion.

On May 11, U.S. Treasury Secretary Janet Yellen, who was attending a meeting of G7 finance ministers in Japan, said that failure to reach an agreement to raise or suspend a debt limit would be “catastrophic.” The US government could run out of money as soon as June 1, calling for an urgent agreement to raise or suspend the $31.4 trillion limit.

On May 12, World Bank President Malpass said that a U.S. debt default would jeopardize the global economy.

Bernard Yaros, assistant director of research at credit rating agency Moody’s, predicted that a U.S. debt default lasting several weeks would cause a recession on the level of the 2008 financial crisis. The U.S. government would stop borrowing altogether by July or August and would have to cut government spending, dealing an overwhelming blow to economic growth.

Currently, about 70% of U.S. debt is held by the U.S. banking system, with the remaining 30% held by overseas investors and central banks in other countries, including Japan, which held $1.1 trillion as of the fourth quarter of last year, China, which held $980 billion, the United Kingdom, which held $870 billion, and India, which held $220 billion. In addition, investment funds and sovereign wealth funds located in the Middle East, Norway, and other places also hold a considerable amount of U.S. debt.

If the decline in the price of U.S. debt triggers a wave of reduction in holdings, the lack of buyers of U.S. debt will lead to a liquidity crisis, directly constraining the effectiveness of the Federal Reserve in implementing monetary policy and making it further difficult for central banks around the world to try to control inflation.

The decline in the attractiveness of U.S. debt as an asset for the global allocation of funds will also have an impact on the attractiveness of U.S. dollar assets leading to a significant depreciation of the dollar and triggering chaotic exchange rate fluctuations. The decline in the strong position of the U.S. dollar could also trigger discussions about alternative currencies to the U.S. dollar.

Bryce Engelland, an analyst at Thomson Reuters, said the rapid currency exchange caused by a sharp decline in the dollar driven by the instability of U.S. Treasuries will lead to chaotic exchange rate fluctuations. Countries will seek to minimize their reliance on the dollar as an international reserve and trade currency, including the creation of new, more isolated trade blocs and making the global economy more fragmented. The resulting combination of trade barriers and global supply chain barriers will make global trade more difficult.

In the absence of a dominant currency in the global trading system, trading blocs will likely erect barriers to trade in the form of requirements to choose their currencies. For example, the euro, the second largest currency, will largely replace the dollar, while the yuan will maintain a strong presence in Asia.

For the global non-developed economies and financially vulnerable countries, the increase in U.S. bond yields will directly drive up market interest rates. Julie Kozack, a spokeswoman for the International Monetary Fund, pointed out that the U.S. debt default will have a serious impact on the United States and the global economy. Plus, rising interest rates will hurt some countries, especially those that are in debt distress and facing vulnerabilities. The organization estimates that 15 percent of low-income countries are in debt distress and 45 percent are at risk.

(Source: bloomberg, cnn, SBS, the irish times, real economy blog)