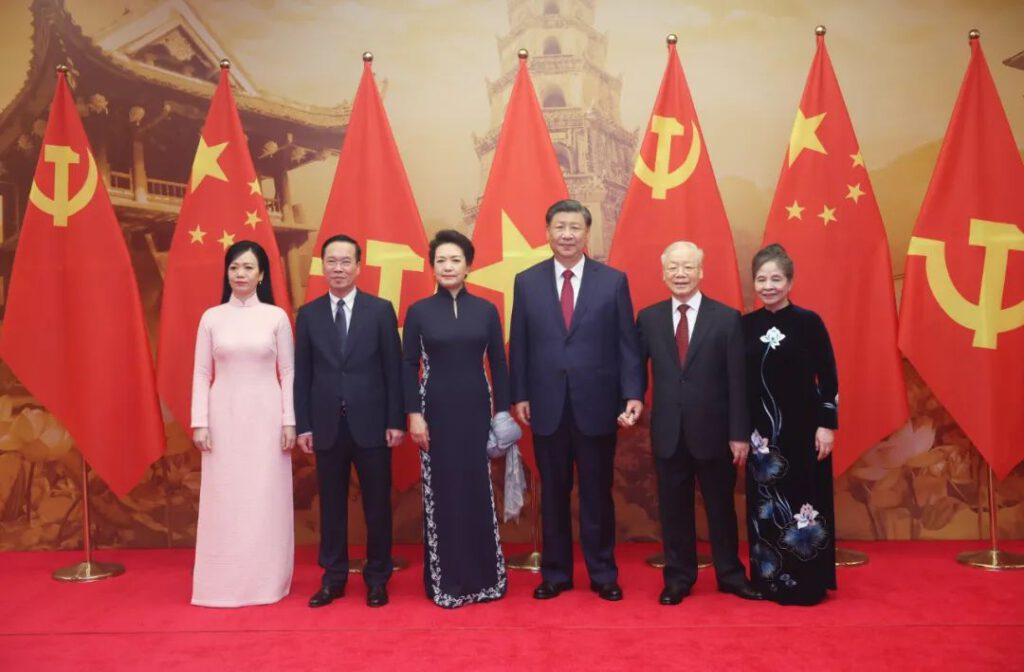

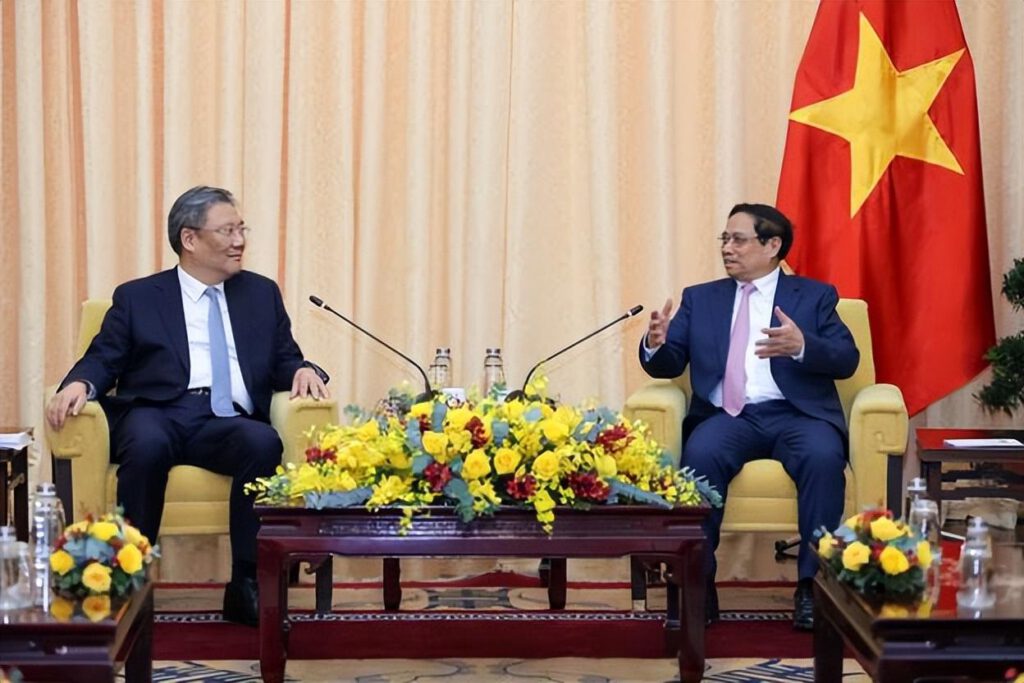

On December 12, Nguyễn Phú Trọng, the General Secretary of the Central Committee of the Communist Party of Vietnam (CPC), hosted a welcoming ceremony for Chinese leaders, punctuated by a 21-gun salute—a gesture symbolizing a warm reception.

Following the ceremonial proceedings, both Vietnam and China released a joint statement emphasizing their commitment to strengthening and elevating their comprehensive strategic cooperative partnership. The statement also underscored the vision of fostering a Vietnam-China community with a shared future, a move that holds significant strategic importance for both nations.

This visit by Nguyễn Phú Trọng marks a significant milestone, coming a year after his landmark trip to China from October 30 to November 1, 2022. Notably, during that visit, he made history by being the first foreign leader to visit China following China’s 20th National Congress of the Communist Party of China (CPC).

Railroad and digital economy cooperation in the spotlight

For two decades running, China has stood as Vietnam’s foremost trading ally. Concurrently, Vietnam ranks as China’s premier trading partner within ASEAN and secures its position as the world’s fourth-largest trading partner, trailing only the United States, South Korea, and Japan.

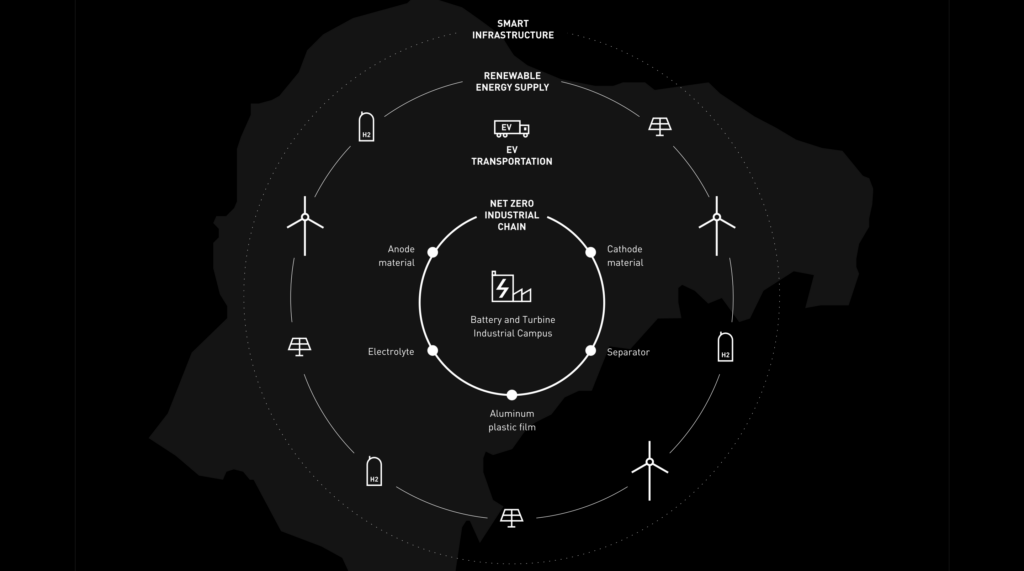

This robust economic partnership between China and Vietnam has evolved significantly. What began as straightforward trade has matured into a deeply integrated industrial supply chain collaboration.

Highlighting the depth of this relationship, Chinese investments in Vietnam have surged exponentially over the past 15 years. From a modest US$2 billion in 2008, Chinese investments have ballooned to an impressive US$25 billion in the current landscape. As of 2023, China has solidified its position as the fourth-largest investor in Vietnam. Impressively, this collaboration spans nearly 60 provinces and cities in Vietnam that have established cooperative ties with their Chinese counterparts.

During this recent diplomatic event, both nations inked 36 pivotal cooperation agreements that spanned a broad spectrum of sectors. These encompassed inter-party exchanges, national security, defense, inter-regional collaboration, justice, strategic alignment, trade and economy, investments, the digital economy, sustainable development, agricultural trade dynamics, and maritime collaboration.

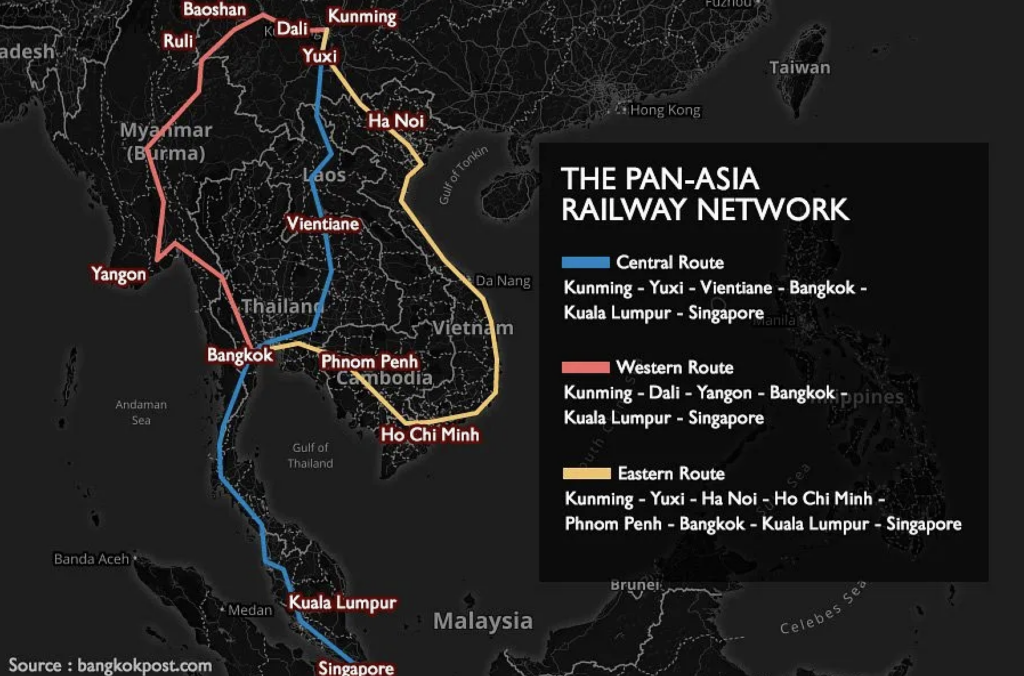

Of notable interest among the signed agreements are those centered on bolstering China-Vietnam railway cooperation and advancing cross-border railway development initiatives.

Vietnam aims to enhance its export capabilities, particularly to China and Europe, leveraging railway infrastructure. Concurrently, the country is looking at infrastructure solutions to address its energy deficits. Vietnamese authorities have expressed a commitment to modernizing the nation’s railway system, specifically aiming to facilitate a railway route linking Vietnam’s rare earth-rich region to Kunming in China’s Yunnan province and extending to Hai Phong in northern Vietnam.

The International Council on Mining and Metals (ICMM) notes that Vietnam possesses the world’s second-largest reserves of rare earth elements, trailing only China. These reserves, estimated at around 22 million tons, represent approximately 18% of global reserves.

Despite this abundant potential, Vietnam has faced challenges in tapping into these resources due to limitations in mining technology, equipment, and nascent processing and application capabilities. In contrast, China stands as the predominant global hub for rare earth processing. Hence, the collaboration between China and Vietnam in the rare earth sector appears complementary, presenting opportunities for mutual benefit and growth.

Rare earth elements are pivotal for various high-tech sectors, with their significance magnified in industries like semiconductors. During his visit to Vietnam in September 2023, U.S. President Joe Biden conveyed a commitment to assisting Vietnam in identifying its rare earth resources and attracting substantial investments. Concurrently, several U.S.-based semiconductor firms have unveiled plans for significant investment ventures within Vietnam.

Furthermore, the digital economy stands as a cornerstone for collaboration between China and Vietnam. Vietnam is ardently championing the advancements of the Fourth Industrial Revolution. In this pursuit, Vietnam recognizes and values China’s pioneering role and expertise in this transformative era of industrial evolution.

Vietnam gives full play to ‘bamboo diplomacy’

Vietnam’s geopolitical significance has been increasingly highlighted in recent times, especially given its unique position in hosting high-profile visits from global leaders amidst the great power rivalry between China and the U.S. Western media outlets frequently emphasize that Vietnam’s role in this dynamic competition is unparalleled.

In a significant move in September 2023, U.S. President Joe Biden embarked on a two-day state visit to Vietnam following his attendance at the G20 summit held in India. This marked Biden’s inaugural visit to Vietnam since assuming office. Both nations declared an elevation in their bilateral ties from a bilateral cooperation and friendship to a Comprehensive Strategic Partnership. With this, the U.S. joined the ranks of China, Russia, India, and South Korea as nations that have established a comprehensive strategic partnership with Vietnam.

Subsequent to this development, Japan and Australia signaled their intentions to mirror the U.S.’s approach by upgrading its relationship with Vietnam to a comprehensive strategic partnership.

Vietnam’s approach to diplomacy is often viewed through the lens of “bamboo diplomacy,” a concept introduced by Nguyễn Phú Trọng during the Vietnam Diplomatic Conference in 2016.

“Vietnam’s diplomacy is described as soft and wise, yet persistent and resolute. It is characterized by being flexible and creative in the face of all struggles and challenges that stand in the way of national independence and people’s happiness. At the same time, it remains consistent, courageous, resilient, united, and humane. The diplomacy is committed to protecting national interests while demonstrating determination and patience.”

Alexander L. Vuving, a professor at Daniel K. Inouye Asia-Pacific Center for Security Studies, interprets the Vietnamese model as the nation’s successful transition from decades of self-imposed isolation and historical animosity towards the West to a more open stance in global affairs.

Moreover, officials from Vietnam’s Ministry of Planning and Investment point out that they don’t position Vietnam as a model for others to emulate. Instead, they emphasize the country’s commitment to continuous evolution and adaptation. Vietnam keenly observes global developments and learns from the experiences of its neighbors. By doing so, Vietnam seeks to avoid potential pitfalls and ensure its sustained growth and progress.

(Source: Ankasam, Gov CN, New Silkroad Discovery)