On August 10, the United Nations Conference on Trade and Development (UNCTAD) released three policy briefs exploring the potential social risks and costs of cryptocurrency implementation in developing countries, including the threats cryptocurrencies pose to financial stability, domestic resource mobilization, and the security of the monetary system.

The report argues that it is important for developing countries to take a cautious approach to the introduction of cryptocurrencies. At the same time, the international community needs to act quickly to initiate a comprehensive global cryptocurrency regulation and information sharing system and implement global tax coordination.

Unregulated cryptocurrencies are costly

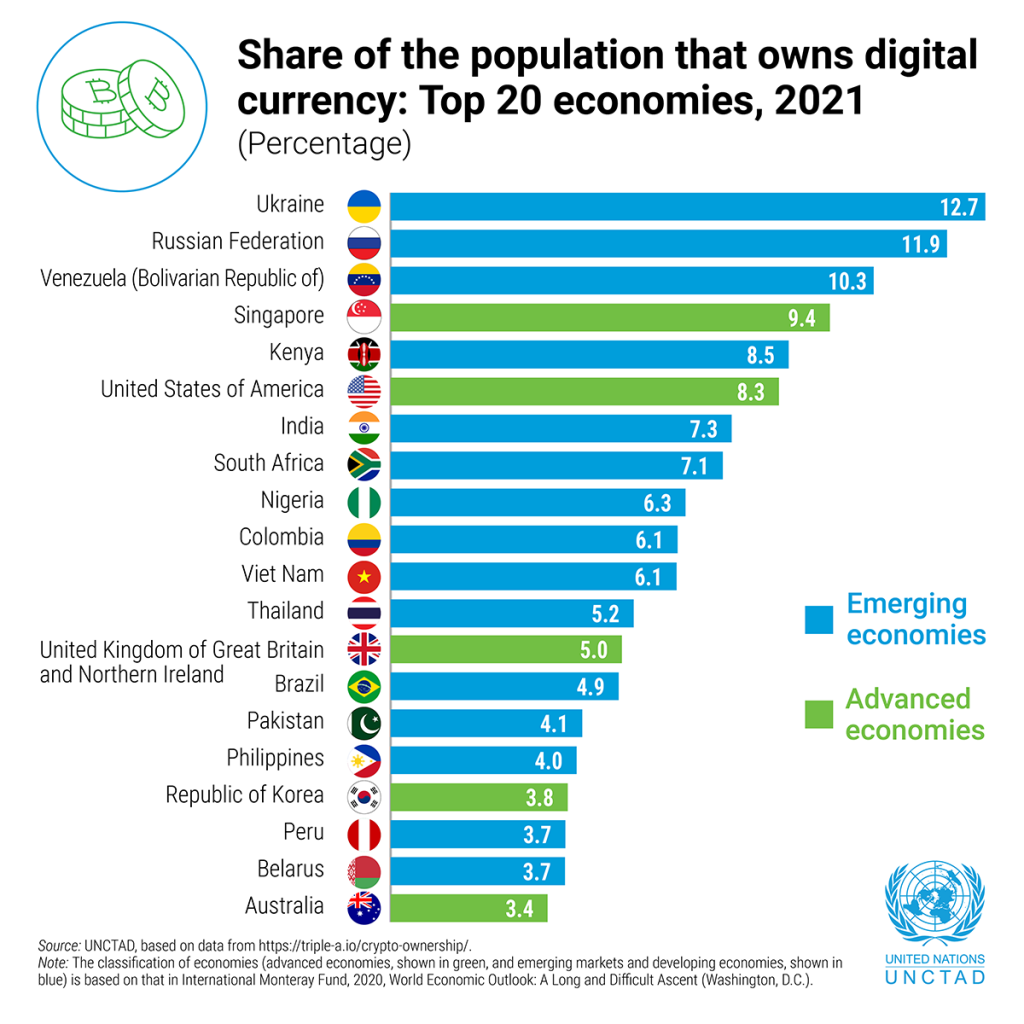

Global cryptocurrency use has shown exponential growth during the COVID-19 epidemic, becoming particularly prevalent in developing countries.

The report shows that a complex and rapidly growing cryptocurrency ecosystem has emerged since the first decentralized cryptocurrency was created in 2009. To date, there are more than 19,000 cryptocurrencies, compared to 1,500 in 2018. A variety of service providers keep the system running, including decentralized financial platforms, cryptocurrency exchanges, and digital wallet apps.

Another important part of the cryptocurrency ecosystem is stablecoin. This new type of cryptocurrency aims to maintain a stable price relative to a sovereign or basket of currencies by holding financial assets as collateral. The report cautions that in addition to the potential for financial losses to holders as a result of falling cryptocurrency values, a more serious problem is that if the price of stablecoin collateral falls, leading to a public bailout, taxpayers will ultimately bear the cost. In May, some stablecoins were no longer pegged to the U.S. dollar, sparking anxiety among cryptocurrency holders and leading to market turmoil with massive sell-offs.

The cryptocurrency ecosystem expanded by an insane 2,300 percent between September 2019 and June 2021, according to the report. There are now more than 450 cryptocurrency exchanges around the world, and daily trading volume once peaked at $500 billion in May 2021, comparable to the trading size of the Nasdaq exchange.

The report notes two main reasons for the rapid popularity of cryptocurrencies in developing countries: as a convenient channel for remittances; and as a hedge against currency and inflation risks in countries facing currency devaluation and inflation. However, the report argues that they pose higher risks and costs in developing countries.

Caution is warranted for several reasons. First, the use of cryptocurrencies could lead to financial instability risks. If prices plummet, monetary authorities may need to step in to restore financial stability. More importantly, in developing countries, the use of cryptocurrencies provides new channels for illicit financial flows. Second, the use of cryptocurrencies undermines the effectiveness of capital controls, which are an important tool for developing countries to contain macroeconomic and financial system risks. Finally, if left unchecked, cryptocurrencies could become a widespread means of payment, or even unofficially replace national currencies, which could jeopardize a country’s monetary sovereignty. The International Monetary Fund has also expressed concern about the risks of using cryptocurrencies as legal tender.

Cryptocurrencies become a new channel for tax evasion and avoidance

The policy notes that while cryptocurrencies can facilitate remittances, they can also enable tax evasion and avoidance through illicit financial flows, like entering a tax haven where ownership is not easily identifiable. As a result, cryptocurrencies may limit the effectiveness of capital controls, a key tool for developing countries to maintain their policy space and macroeconomic stability.

The report shows that developing countries face significant challenges in promoting structural transformation and sustainable development while achieving the 2030 Agenda for Sustainable Development.

According to UNCTAD estimates, developing countries will need about $3 trillion per year from 2020 to 2025 to bridge the financing gap. Financing for development requires a two-pronged approach: on the one hand, developing countries need to mobilize additional resources from multiple areas, including from international and domestic, public, and private sectors. On the other hand, they need to address financial leakages. However, illicit financial flows and persistent net financial outflows, both channels, drain resources from developing countries. These channels erode tax revenues and shrink developing countries’ fiscal space and ability to provide basic public services and infrastructure. And, they exacerbate the external financing needs of developing countries, trapping them in debt.

The report highlights that since the 2008 global financial crisis, some measures have been taken at the multilateral and national levels to reduce commercial and tax-motivated illicit financial flows, but these efforts have not included cryptocurrencies, which have become a new channel for tax-motivated illicit financial flows.

While there is concern about the attractiveness and potential use of cryptocurrencies for criminal activity, it is estimated that this represents a relatively small share of cryptocurrency transactions, with less than 10% of total bitcoin transactions in 2020 attributable to criminal activity. However, the report argues that even if unrelated to criminal activity remains problematic from a development financing perspective, as eroding tax bases and undermining capital controls are key issues for developing countries.

Calls for comprehensive cryptocurrency regulation in developing countries

As of November 2021, 41 countries, compared to 15 in 2018, have banned banks and other financial institutions from trading in cryptocurrencies or banned cryptocurrency exchanges from offering services to individuals and businesses. Of these, nine developing countries, namely Algeria, Bangladesh, China, Egypt, Iraq, Morocco, Nepal, Qatar, and Tunisia, have banned cryptocurrencies altogether. There are also some countries that impose income taxes on capital gains generated from cryptocurrency transactions. In addition, cryptocurrency exchanges are subject to anti-money laundering and counter-terrorism financing laws in countries such as Australia, the Bahamas, Greece, Romania, the Philippines, and Uzbekistan.

However, the report notes that despite regulatory responses, cryptocurrencies remain in a legal gray area in most developing countries. The cryptocurrency ecosystem is inherently global, and many of its components, such as decentralized financial platforms, cryptocurrency exchanges, digital wallet providers, and stablecoin issuers, are outside of national jurisdiction, making cryptocurrency regulation a challenge. The report argues that key regulatory measures to mitigate the global risks posed by cryptocurrencies need to come from developed countries, as this is where most providers are headquartered.

UNCTAD urges developing countries to take action. Specific policy recommendations include ensuring comprehensive financial regulation of cryptocurrencies by regulating cryptocurrency exchanges, digital wallets and decentralized open finance, and prohibiting regulated financial institutions from holding cryptocurrencies or offering related products to their customers; restrict cryptocurrency-related advertising in the same way as other risky financial assets; provide a public payment system that is safe, secure, and affordable for the digital age; agree on and implement global tax harmonization for the tax treatment, regulation, and information sharing of cryptocurrencies; redesign capital controls to take into account the decentralized, borderless and anonymous nature of cryptocurrencies.

(Source: UNCTAD, Timeline News Nigeria)