On January 30, Trump signed an executive order aimed at combating anti-Semitism, specifically targeting U.S. universities. He also announced the formation of an inter-agency task force to enforce this order. This move gained momentum after a pro-Palestinian sit-in protest at Barnard College on February 26, which led to several arrests. Two days later, the Trump administration released a list of 10 schools: Harvard University, George Washington University, Johns Hopkins University, New York University, Northwestern University, the University of California, Los Angeles, the University of California, Berkeley, the University of Minnesota, Columbia University, and the University of Southern California, for review to determine whether corrective measures were necessary.

Throughout 2024, as tensions surrounding the Palestinian-Israeli conflict intensified, these universities became focal points for large-scale protests and clashes. Previously, Trump stated on social media that he would punish any institution that allowed “illegal” protests.

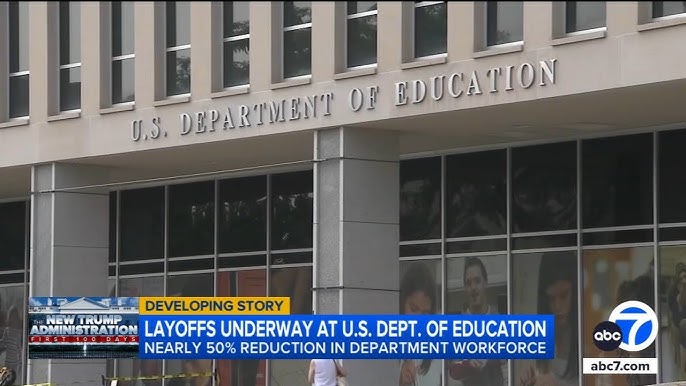

On March 7, the Trump administration abruptly withdrew $400 million in federal funding and government contracts from Columbia University. According to reports, this action followed the university’s inclusion on the U.S. Department of Justice’s review list for possible failure to protect the safety of Jewish students and faculty, prompting a task force to intervene.

On the same day, thousands of researchers and their supporters gathered at the Lincoln Memorial in Washington, D.C., for the “Stand Up for Science” rally, organized by five graduate students and recently fired federal workers. The protest was aimed at condemning President Trump’s anti-science policies since his inauguration nearly seven weeks earlier.

The rally targeted policymakers, urging the administration to end censorship of scientific research, restore federal funding, reinstate federal employees, and preserve diversity and inclusion in science. Over a dozen speakers participated, including a Democratic senator, a former Republican congressman, and Dr. Francis Collins, former director of the National Institutes of Health (NIH).

A congressional spokesperson stressed the importance of understanding public opinion and encouraged constituents to express concerns to their legislators. A federal scientist at the rally, speaking anonymously, explained that budget cuts had hindered his ability to do his job and hoped the protest would raise awareness of the harm done to science.

Gretchen Goldman, president of the Union of Concerned Scientists (UCS), which had sent a letter signed by more than 50 scientific societies to Congress urging protection for federally funded science, was among the speakers. She warned that without funding for disease prevention and treatment research, public health would suffer.

Organizers of the “Stand Up for Science” event hoped to inspire scientists and the public to take a stand against the Trump administration’s attacks on science. The rally was a continuation of the 2017 March for Science protests during Trump’s first term. In addition to Washington, D.C., the event was planned to include 30 protests across the U.S. and more than 150 globally.

Meanwhile, the Trump administration had begun sending questionnaires to overseas researchers in Australia, the United Kingdom, the European Union, and Canada, asking if their U.S.-funded projects were related to topics like diversity, equity, and inclusion (DEI), climate, and environmental justice.

The survey also inquired about potential financial ties with countries such as China, Russia, Cuba, or Iran. Projects that did not address these issues scored higher, while those with collaborations with certain countries scored lower. Some European universities advised their researchers not to respond, while Australian universities, more dependent on U.S. funding, encouraged participation.

This initiative has faced strong opposition from university consortia and research organizations globally, who argue that many of the questions go beyond traditional grant compliance and threaten the integrity of U.S.-led research programs. Administrators from institutions in Australia, Canada, the Netherlands, and beyond expressed concern that this was a sign of deteriorating academic freedom in the United States.

On March 31, the U.S. Department of Health and Human Services (HHS), the Department of Education, and the General Services Administration (GSA) announced a comprehensive review of U.S. federal contracts and grants to Harvard University and its affiliates, totaling over $255.6 million in contracts and more than $8.7 billion in multi year grants. This action is part of the Trump administration’s broader crackdown on anti-Semitism on college campuses, mirroring earlier scrutiny of Columbia University.

On the same day, over 1,900 academicians from the National Academies of Sciences, Engineering, and Medicine signed an open letter urging the Trump administration to cease its attacks on the scientific community. The letter included prominent scientists from China. The signatories argued that the administration’s cuts to research funding, the firing of thousands of scientists, the removal of public access to scientific data, and the ideological influence on research were undermining U.S. science. They issued a call to action, warning that the American research system was being dismantled and urging the public to support their efforts.

With over 8,000 members across the three U.S. academies, the signatories already represent nearly a quarter of the total membership.

The academics argue that the administration’s cuts to research funding are hindering the training of future scientists, while its investigation of more than 50 universities threatens the integrity of scientific research at higher education institutions. Moreover, the administration’s suppression of research it deems unacceptable undermines the independence of science, fostering a climate of fear within the U.S. research community. In response, these academics are calling on the Trump administration to cease its assault on the scientific community and urging the public to support this cause.

Source: Science News, ABC News