At the 28th United Nations Climate Conference (COP28), Xu Hao, Vice President of Sustainable Social Value at Tencent, represented the Innovate for Climate Tech, introducing the Alliance and its supporting platform TanLIVE International.

The Innovate for Climate Tech, under the leadership of the COP28 Presidency, aims to expedite low-carbon innovation by bringing together pioneers and innovators in the global climate sector. Currently, dozens of renowned organizations, including McKinsey, Link, ADB, Siemens, MIT, and others, have joined the alliance. During the conference, Investcorp, a global investment organization, announced its membership and established a US$750 million low carbon fund for this purpose.

TanLIVE International, developed by Tencent, serves as the official support platform for the alliance. It is a free and open low-carbon UGC platform connecting low-carbon resources globally. Since its launch in 2022, thousands of users from various organizations and institutions have joined the Chinese version of TanLIVE.

Through TanLIVE, individuals can engage with a diverse community, accessing users, information, and knowledge in the low-carbon field. This interconnectedness is envisioned to drive change and action.

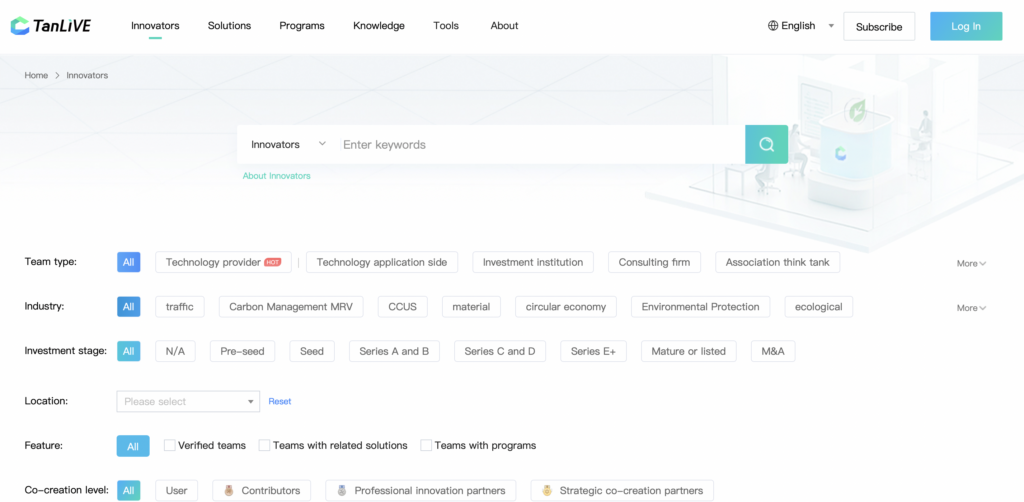

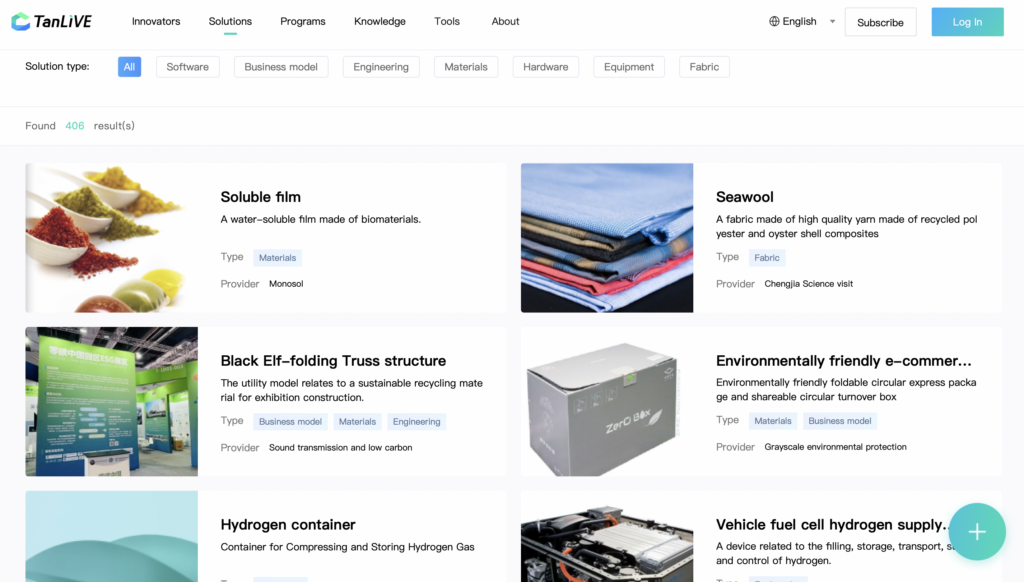

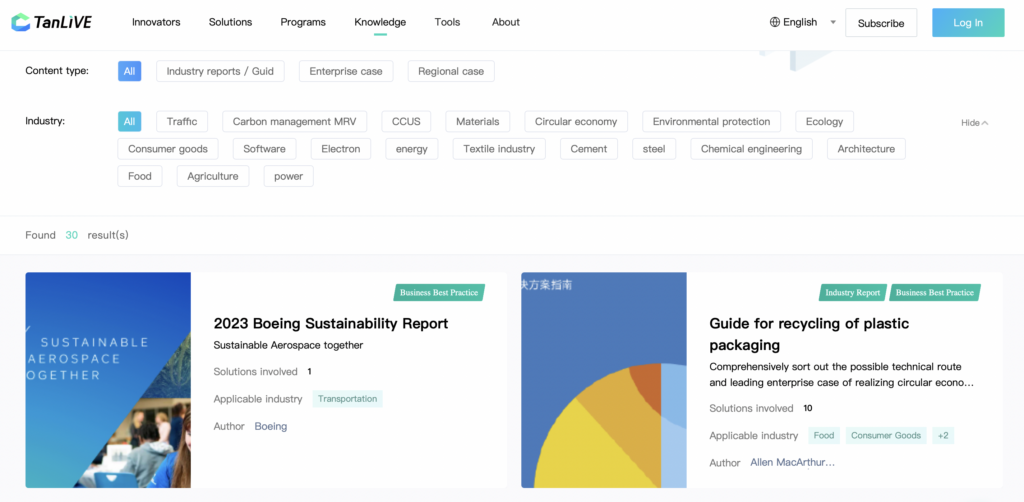

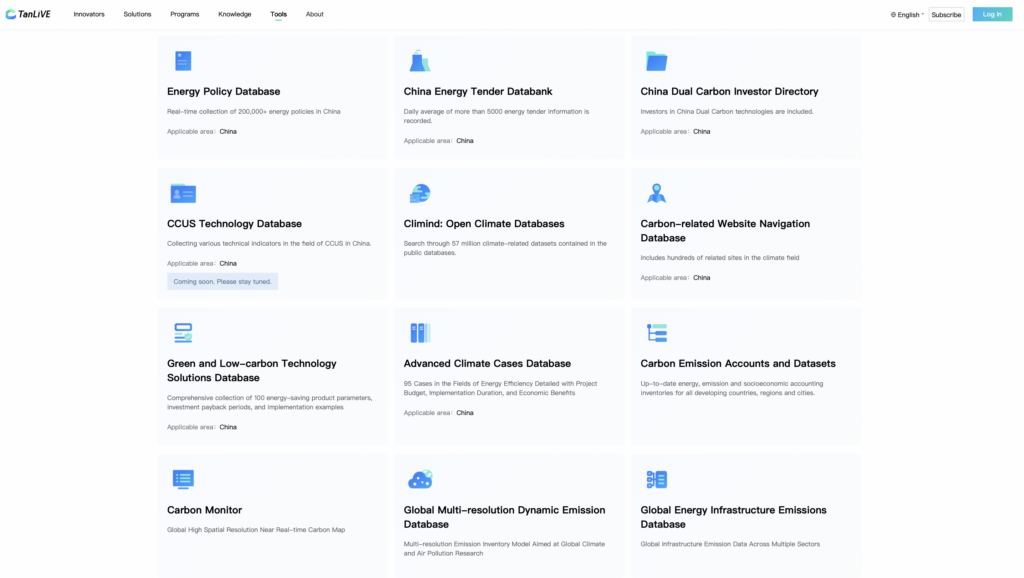

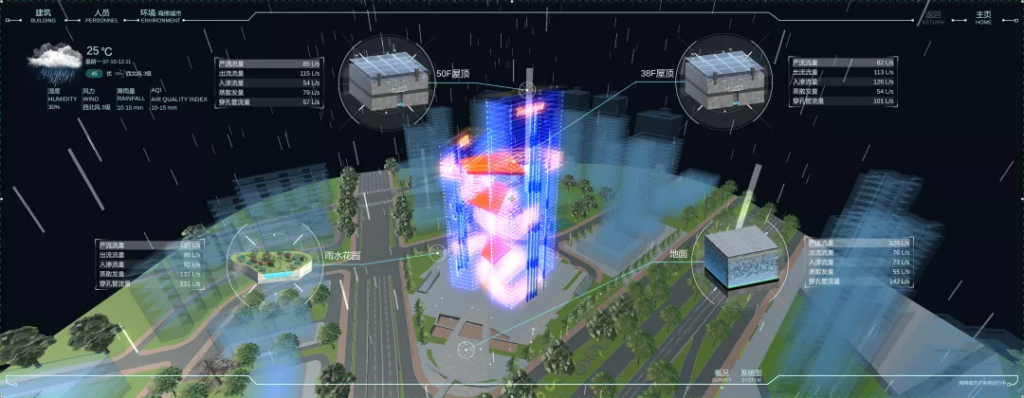

TanLIVE focuses on three major functions: resources, tools, and user systems:

- Resource Planet enables enterprises, investors and incubators to publish their supporting resources to entrepreneurs.

- Tool Lab gathers policy insights, data, and analysis tools required for low-carbon innovation.

- TanLIVE Passport integrates user accounts for all partner sites, enabling users to access various resources and tools with just one unified account.

In this ecosystem, entrepreneurs can showcase their technologies efficiently, accessing support resources and advancing their technologies. Enterprises and investors can search for low-carbon products and technologies while learning about low-carbon transition paths and cases. Local governments can release preferential support policies, attracting entrepreneurial teams and publicizing local carbon-reducing achievements. For think tanks and industry experts, the platform offers a means to make their research more accessible and build upon the work of others.

C Team, a public service organization that has evolved alongside TanLIVE, seeks to address its own challenges using this tool. For instance, they spent over a year producing a report guiding the low-carbon transition of the apparel industry. Unfortunately, the report faced challenges gaining visibility after release, and its impact was limited until integrated into TanLIVE.

Yang Peidan, Director of C Team, notes that TanLIVE is a dynamic toolkit guiding the sustainable transformation of the apparel industry step by step. As an example, brands aiming to use corn as a raw material for clothing in the future can find relevant technologies and suppliers on the platform’s action map. Additionally, manufacturers can create accounts directly on the platform to attract brands interested in purchasing corn fiber fabrics.

In mid-2023, the organizing committee of COP28 approached Tencent with the aim of exploring cooperation opportunities in the field of low-carbon technology innovation. The UAE, as the chair country of COP28, proposed the development of Masdar City, an environmentally friendly city on the outskirts of Abu Dhabi, designed to be the world’s first city to achieve zero carbon and zero waste, following the establishment of an online platform to promote the global exchange of low-carbon technologies.

After several months of development, the TanLIVE International version was officially launched at COP28 on November 30th and became the official support platform of the Innovate for Climate Tech.

Yingya Zhou, product manager of TanLIVE, emphasized that the international and domestic versions are not two independent systems but a designed system from the start, with the goal of enabling interoperability across borders, creating a global ecosystem in the low-carbon space.

As an example, when a Chinese user releases a technical introduction of a Chinese product, the content is presented in the appropriate language for an African user’s cellphone. Achieving this effect goes beyond a simple switch between Chinese and English; it relies on Tencent Cloud’s multi-location deployment, content distribution, and AI automatic translation support.

With the acceleration of global temperature rise, technological innovation has become a beacon of hope for addressing climate issues.Low-carbon technologies should undergo global pilot testing, followed by widespread promotion after rapid validation. Similarly, technology seekers should look for the most suitable technologies on a global scale. TanLIVE serves as the tool to facilitate this process.

For instance, if the Middle East is grappling with a significant challenge of transitioning from oil and gas, lacking low-carbon technologies and seeking to introduce clean energy across industries or early-stage CCUS (Carbon Capture Utilization and Storage) technologies, individuals with these technologies can explore opportunities in the Middle East. Given China’s vast industrial sector, low-carbon technologies from various countries in the industrial sector can also seek pilots in China.

The emergence of the Innovate for Climate Tech and TanLIVE is precisely to expedite this process and counter the global temperature rise. Xu Hao emphasized that each country has unique national conditions, and Tencent, understanding China well, aims to assist China in introducing and exporting low-carbon technology.

Simultaneously, enterprises in the UAE, with a deep understanding of their country, can contribute to this logic. By forming a synergistic approach, there is potential for low-carbon technology from around the world to effectively land and make an impact globally.

“Connection is the gene of Tencent; connection creates value. From QQ to WeChat to Enterprise WeChat, Tencent’s product logic remains consistent, and TanLIVE is no exception,” added Xu Hao.

(Source: TanLive)